In Europe, manufacturers and operators of unmanned aerial vehicles must navigate a complex regulatory landscape, as studded with obstacles as the terrain over which their aircraft fly. Anyone wanting to enter this market must be ready to peel back layers of documentation and jump through diverse political hoops. But a handful of optimistic, or perhaps just stubborn, researchers and entrepreneurs are building the sector from the ground up, while lawmakers do their best to keep pace.

To say that the European unmanned aerial vehicle (UAV) industry has drawn a crowd may be understating things. According to Paris-based UAV International, the non-profit association representing European UAV manufacturers, the European Union (EU) counts more than 1,000 “approved and authorized” civil UAV operators within its borders. Others put that number at closer to 1,400.

Then again, some caution about overstating the numbers. Speaking about the UAV-based mapping sector, one of Europe’s optimistic UAV entrepreneurs, Peter Cosyn, co-founder of Belgium’s Gatewing, points out, “There are probably about 30 companies in the EU, Russia, Asia, and the Americas that really profile as a manufacturer of mapping and surveying (unmanned aircraft systems) and consist of more than just a guy with an idea and a prototype.”

So, just what does approval and authorization imply in Europe?

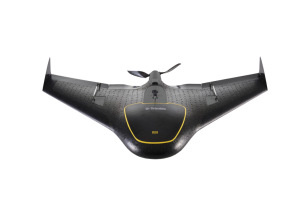

A rendering of the Delair-Tech DT-18, designed and built by Delair-Tech and operated by Red Bird, both of France.

Art courtesy of Delair-Tech

Regulatory Environment: Too Much or Too Little?

Governmental authorities in various EU countries have shown great interest in the use of UAVs, especially in the context of internal security. Organizations considering UAVs include municipal and national police forces, anti-terrorism squads, city fire brigades, forest fire fighters, coast guards, civil defense authorities, and environmental protection agencies, as well as groups responsible for EU border security.

At the same time, large European corporate entities—from electric grid, pipeline network, and railway operators to oil companies—have awakened to the fact that UAVs could serve useful and profitable functions.

But—and this is a rather large “but”—the use of UAVs in Europe is currently limited by the fact that national, and not EU-level, civil aviation authorities (CAAs) retain the power to grant flight authorizations, largely on a case-by-case basis, involving burdensome procedures and mandates to stay in segregated airspace.

The European Commission—the powerful, trans-European administrative/executive body based in Brussels—says it does not want to change the way air traffic services are provided to suit the needs of unmanned aircraft. In its view, existing aviation practices will remain in place and the unmanned aviation industry will have to adapt their practices to accommodate them.

While some CAAs have issued or are about to issue national regulations, these regulations are not necessarily aligned to one another, thus creating an unwieldy situation across the continent.

Specifically, countries including the Czech Republic, France, Germany, Ireland, Italy, the Netherlands, Norway, Romania, Sweden, and the United Kingdom now have national regulations addressing the operation of civil UAVs, while Austria, Belgium, and Spain are putting regulations in place. Other EU countries, nearly half, have yet to address the issue.

In practically all cases, operations must take place within visual line-of-sight, at a flight altitude of less than 500 feet, with a maximum take-off mass of less than 25 kilograms. These flights are principally undertaken by small or medium-sized enterprises.

All agree that, at the very least, all the territories—that is, nations or member states—of the European Union need some kind of covering regulation, and ideally there should be an overarching EU UAV regulation.

In the absence of such a harmonized, broad-spectrum approach, however, individual member states are forging ahead—or lagging behind—mostly on their own.

The United Kingdom is one of those countries ahead of the curve, with a clear set of UAV rules on the books.

All UAVs operating in the UK, whatever their mass, are treated as aircraft, and as aircraft they are subject to the Air Navigation Order—Rules and Regulations, currently referred to as the ANO2009. Within this, there are a number of articles that relate to small UAVs and specifically to those used in surveillance.

The UK CAA has specified a number of requirements that have to be met before it will issue a ‘Permission to Carry Out Aerial Work’. These requirements include an airworthiness certificate, a design and construction certificate, pilot qualification, insurance and organizational approval.

So anyone operating a UAV in the UK pretty much knows what’s expected. No anarchy in the UK. But in other nations, the picture is not so clear.

Belgium’s Trimble UX5

A Case Study: Belgium

A more typical case may be that of Belgium, a small country with a strong high-tech profile that hosts much of the bureaucratic infrastructure of Europe, which has yet to settle the issue of UAV regulation and market development.

As a nation, Belgium currently has no regulation that specifically governs UAVs, although rules are being crafted in the form of a “Royal Decree,” an executive order written by a government official implementing a law and signed by the nation’s monarch.

Ostensibly, authority over UAVs in Begium is spread across a half dozen agencies, sometimes with apparently overlapping responsibilities, and similar scenarios are playing out all over Europe right now. Belgian rule-makers include:

Belgocontrol—An autonomous public company, Belgocontrol safeguards Belgian airspace, monitoring and controlling air traffic, using air traffic towers and radar systems to secure and safeguard pilots, passengers, and people on the ground.

Belgian Ministry of Defence—Belgian military officials have authority over all military aviation and control all military airspace in the country.

Belgian Institute for Postal Services and Telecommunications—BIPT has jurisdiction over all radio communication and frequency issues. An independent government institute, the BIPT can impose sanctions for improper use of radio or other communications installations. This can represent an important factor for UAV operators who need a radio communication link to exercise control and communication over their aircraft. Both the radio transmitter and receiver must be approved and certified for use. However, there are currently no appointed frequencies for UAV operations.

Belgian Civil Aviation Authority (BCAA)—Part of the nation’s Federal Civil Service for Mobility and Transport, the BCAA—also known as the Directorate-General for Air Transportation—oversees civil aviation in Belgium.

European Aviation Safety Agency (EASA)—Although an EU agency under the jurisdiction and supervision of the European Commission, EASA executes European laws in a national framework and can also perform control and supervision. For unmanned aircraft in Belgium and other member states, EASA has jurisdiction over UAVs with a takeoff mass of 150 kilograms or more.

EUROCONTROL—Founded by the EU member states but independent of the EU, this organization is tasked with safeguarding higher airspace—above 24,500 feet.

So, a lot of entities might, would, or could play a role in the Belgian UAV scene.

MAvinci unmanned autonomous microplane is ready to take off for a land survey mission.

Photo: www.esa.int

Industry Perspective

On the operators’ side, the BeUAS is a network that defends the interests of Belgium’s civilian unmanned aviation sector. In the absence of legislation, many groups of this type have sprung up around Europe with the goal of helping each other navigate the ins and outs of growing the market segment in spite of the confusion.

BeUAS President Michael Maes says if you want to fly a UAV in Belgium, you have to ask the BCAA.

“Operators in Belgium can usually get permission to undertake non-commercial flights, meaning for R&D, testing, training or government purposes. If anyone is operating commercially, then they do not have any permission to do so from the BCAA.”

But does that mean…?

Yes, says Maes, “It is clear that most of the operators flying in Belgium today are doing so illegally.”

Of course, Maes hastens to add, BeUAS does not encourage this situation.

“We do not want our members to fly unsafe, which means flying in prohibited, restricted, dangerous or controlled airspace without any permission,” he says.

But this is what it comes to: Maes would like to see everyone follow the rules. But few rules exist for UAVs and, with money potentially to be made it a “wild frontier’ scenario.

The lack of dedicated radio frequencies allocated to UAVs by the International Telecommunication Union (ITU) doesn’t help, Maes adds.

“For the dedicated frequencies, 2.4 GHz is used in 98 percent of the small drones because it is a civil band which can more or less be used by anybody,” he explains. “It does create issues such as interference with WiFi or car keys. The power limitations also limit the safety of long distance operations, going farther than one kilometer or around or within buildings.”

BeUAS has been a key partner to the BCAA, helping to hammer out the upcoming royal decree that will put Belgium’s UAV house in order when it comes into force, hopefully later this year.

Then again, let’s remember what we are talking about—the Belgian Royal Decree will set the rules and regulations for UAV operations in Belgium, but the problem of a pan-European regulatory framework still remains.

A Delair-Tech UAV sits poised on its stand.

Photo: Delair-Tech SAS

Meanwhile, Back at the Lab

Despite the absence of a European-wide regulatory framework, UAV-related research and innovation have marched steadily forward.

Jon Verbeke is a lecturer and doctoral candidate at the KU Leuven University campus in Oostende. His Ph.D. thesis focuses on design of a new configuration of multicopter UAV that can navigate autonomously through an orchard—instead of above it.

Verbeke and colleagues from sister college university Vives, have designed and produced several UAVs, from very small, up to 6 meters in wingspan and 65-kilogram maximum weight, with electric propulsion.

In any case, he reminds us, “Commercial use of UAVs in Belgium is forbidden. Permits can only be applied for demonstration, scientific or governmental purposes—for the greater good—and this is on a case-by-case basis. Even for universities this is problematic. Testing of a new UAV is difficult, and there is lots of paperwork. The BCAA requires a technical construction file, an operational manual and a safety manual to approve test flights.

“But also,” he says, “since the industry is moving so slowly because of the lack of regulatory framework, the universities cannot benefit from the R&D within industry and vice versa.”

Returning to matters of technology, Verbeke cites the central role of GNSS in UAV applications and his expectation that new systems such as Europe’s Galileo will enable developers to achieve the centimeter-level positioning that his UAV project needs.

… and in the Market

While academic research groups like the one at KU Leuven stand at the forefront of new and exciting technological innovations, commercial operators such as Gatewing, Orbit GIS, and Switzerland-based SenseFly are moving directly to providing products and services and making money.

Gatewing is a Ghent-based company founded in 2008 and acquired by U.S.-based GNSS pioneer Trimble in 2012. Products include the Gatewing X100, a turnkey mapping and surveying drone on the market since 2010, and the recently launched Trimble UX5.

The company’s co-founder, Peter Cosyn, says, “Our main user is the surveyor who is focused on asset mapping. He typically works for a service company or is an internal supplier of geospatial data for a big company. The surveying company is our main client but we also sell to new companies that focus on UAS services.”

These include mining, engineering, and construction companies along with clients in agriculture, forestry, energy, dredging, government and “a significant number of universities.”

“The main issue,” Cosyn says, “is the fact that we can only deal with some national rules at the moment and the big guys that make the international framework [the International Civil Aviation Organization], the U.S. rules [Federal Aviation Administration] and the EU rules (EASA) are still doing their homework.

“This clearly limits the market potential at the moment, especially if you are a professional company that follows the rules and not a ‘cowboy’ that just ignores them,” Cosyn says.

“Some countries, including the U.S., do not allow commercial applications. Others have rules with strange requirements, typically borrowed from manned aircraft, have no rules but a case-by-case procedure, or have rules that are clearly directed by local UAS manufacturers and as such protecting their market.”

“Harmonization,” Cosyn says, “will be key to making this market a success.”

And with that, we are all back on the same page.

“Due to the status of the regulations,” Cosyn concludes (and the economic downturn), “Europe is definitely not the big market at the moment, but can well become one of the main markets in the future.”

MAVinci autonomous micro air-vehicle surveys an open mining site.

Photo: www.esa.int

National to European

Erika Billen is a communications, navigation, and surveillance engineer at the BCAA and the person responsible for allowing operators to fly UAVs in Belgian airspace.

She says she faces two main challenges today: First, “Dealing with illegal UAV operations,” and second, “Convincing the authorities—the Ministry of Transport, and civil and military air navigation service providers—of the need for full integration of UAVs. Because of the applications and the needs in society, we need to move as quickly as possible toward operations in all conditions.”

Billen is one of the people who understands the urgency, and not just for her country. “We are taking a step-by-step approach, but we do not want to spend 20 years on it. The market will not accept this at all.”

She is about helping Belgians and others exploit the new UAV opportunities:

“We allow test and demonstration flights to facilitate the development of these new opportunities,” she says. “We also allow training flights for student pilots. The next step will be to try to eliminate the issues around air navigation service provision, to integrate UAVs more and more into Belgian airspace.”

On the other hand, Billen is realistic about the larger issues.

“It is important to underline,” she says, “that asking every individual [EU] Member State to make its own national legal framework is very inefficient and very time consuming. It ends up in fragmentation, which is very inconvenient for the operators and puts a brake on the free movement of goods and services within the European Union.”

The EU RPAS Roadmap

So where is Europe? Seeking to form a more perfect Union. The EU, led by the European Commission, is moving toward a better and all-encompassing regulatory framework for UAVs (remotely piloted aircraft systems, or RPAS—in EU parlance).

Between 2009 and 2012, the Commission conducted a broad stakeholders’ consultation to examine the economic impact of, and to identify the obstacles to, the development of civil UAV applications.

Among other things, the consultation concluded that UAVs need to be integrated as swiftly as possible into the European air system, requiring necessary EU aviation regulations to be put in place. Thus was born the Commission’s “Roadmap for Safe RPAS Integration into European Air System,” or simply, the RPAS Roadmap.

The Commission believes that solid business cases for UAV operations require internationalization beyond national markets, with a true European “single market” for RPAS based on common rules as the ultimate goal.

However, with 28 independent member states that have to act in concert, nothing is likely to happen quickly.

The Roadmap’s Regulatory Work Plan identifies 27 regulatory improvements to be achieved within various timeframes, running all the way out to 2028. Based on previous experience, this 2028 target could stretch well into the 2030s if not beyond.