Satellite companies have begun launching thousands of low-orbiting spacecraft built to offer internet connections and streaming media to air passengers, maritime travelers, and people in remote and underserved areas. But the advanced connectivity created by these systems and supported by their target markets can also make it possible for drone operators to quickly transmit, process and return data for the still-nascent agricultural drone sector.

Even before the rules for commercial drone operations were drafted, the idea of using unmanned aircraft to monitor crops, diagnose problems and help farmers boost yields had captured drone proponents’ imaginations. Though the potential of overhead imagery of agricultural fields was made clear by remote sensing satellites, drones took it a step further by enabling on-demand access, easy repeat flights and higher resolution. As a result, agriculture was expected to be a top, if not the top, market for unmanned aircraft systems (UAS). Moreover, the sparsely populated expanses of America’s farm states were such a low-risk place to fly that it seemed possible regulators would quickly grant waivers and allow flights to commence.

But the broad market for agricultural drones failed to sprout. The economics were difficult without the ability to fly drones long distances—that is, well beyond the visual-line-of-sight limits now imposed—something regulators are working hard to fix. Unanticipated and much harder to solve, however, was a lack of rural broadband infrastructure. Without readily available high-grade connectivity, drone images could not be loaded to the cloud and processed fast enough for many farmers’ needs. Without broadband internet, much of the agriculture use case for drones was plowed under.

But farmers and drone operators may not have to wait much longer. A swiftly emerging new class of communication satellites is poised to create high-capacity connectivity for everyone everywhere.

WHAT A FARMER NEEDS

“If you think about it, in rural America, one of the biggest challenges we have is connectivity—especially when you’re utilizing imagery from drones,” said Robert Blair, a fourth-generation wheat farmer who has been using drones on the 1,500 acres of Blair Three Canyon Farms in Kendrick, Idaho, since 2007.

The processing and analysis of drone-generated data absolutely requires the high-end computing power of the cloud, Blair said. “If you’re trying to process on site—the amount of processing power needed for that amount of data—I mean, you need a huge computer or a computer with super-good capabilities.”

The issue is partly the amount of data involved. A single drone taking images can collect 50 to 60 gigabytes (GB) of data in a day, Blair said. Blair also processes the same images repeatedly, looking for different things. “The biggest cost, which is time and money, is getting that initial data set and from that data set, then you pay for the processing for weeds, insects, disease, nutrients, water—on down the line.”

The first challenge is determining if you need to reshoot. That means getting data to the servers, having it assessed and returning feedback in an hour or less.

“If I’m doing flights in the field, can I have that information back to me before I leave a site, to see if I have good data?” Blair asked. “Because the cost to get somewhere to do the flights with the drone—that’s what it comes down to is that nonproductive time factor. …So if I can maximize my time in an area and get the correct data, that’s huge.”

Weather is also always a factor. The farmer may need detailed insight into fertilizing poor-yielding acreage or treating a crop against pests before a weather shift, like the onset of high winds, makes action less productive or even pointless.

“For insects or disease,” Blair said in an earlier interview with this magazine, “every day [a field is] left untreated you can start losing 1 to 5 percent of the crop—not only in quantity but you get quality issues. For nutrients, fertilizer, you can do the same thing with the timing. If you have a rain storm come in and it’s the last rainstorm of the end of the season—the growing season—for a crop you could, on wheat, lose 10 bushels per acre.”

A 10-bushel loss can translate into real money. If wheat is $6.50 per bushel and you lose 10 bushels or 10 percent of a 100-bushel/acre yield on 1,000 acres of wheat, that’s $65,000 out of the farmer’s pocket. “That’s the difference between 12 and 24 hours. That’s why being timely is so, so crucial,” Blair said.

Ultimately, Blair said, the desire is to upload the raw images and get back the results in real time. “We need to make decisions as soon as possible, and so as things progress, real-time analysis is what’s going to be necessary.” But without the ability to upload directly to the cloud, Blair’s been FedExing data cards for processing.

There have been multiple proposals to expand rural broadband, a standing priority for both state and federal agencies. The Federal Communications Commission (FCC) recently voted to allocate $20.4 billion to rural broadband over the next 10 years with the first $16 billion going to areas with no high-speed broadband. The Democrats have a plan to invest $98 billion over five years in new infrastructure.

But even with big budgets, constructing cell towers and laying cable takes time. A lot of time. And there may be a much faster option: companies are now launching massive constellations of small satellites that could provide the upload and download capability to provide any point on Earth with vastly improved turnaround times for processing images and, perhaps someday, real-time results.

THINK BIG—REALLY BIG

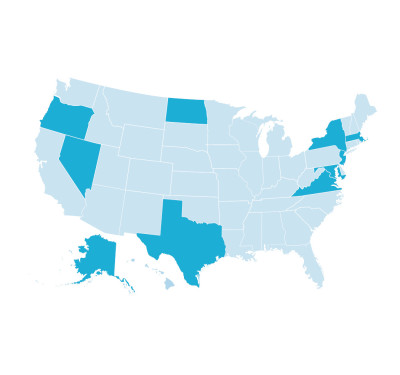

The mega-constellations get their moniker from the large numbers of satellites they intend to employ. Though there are a number of constellations in various stages of development the three that appear most likely to be the first able to offer the kind of services drone operators need are Starlink, OneWeb and Telesat.

Starlink, which is being developed by SpaceX, could ultimately have up to 42,000 satellites in various low-Earth orbits—some just a few hundred miles up. Thus far it has the FCC’s permission to launch a constellation of nearly 12,000 satellites and is seeking approval from the International Telecommunication Union for the rest.

As of late January of this year, SpaceX had more than 240 Starlink spacecraft in orbit and reportedly planned for six more launches of 60 satellites over the year. SpaceX CEO/founder Elon Musk has said it will take at least 400 Starlink satellites in orbit to offer “minor” broadband coverage and at least 800 to provide “moderate” coverage. An initial configuration for the full service would require 1,584 satellites.

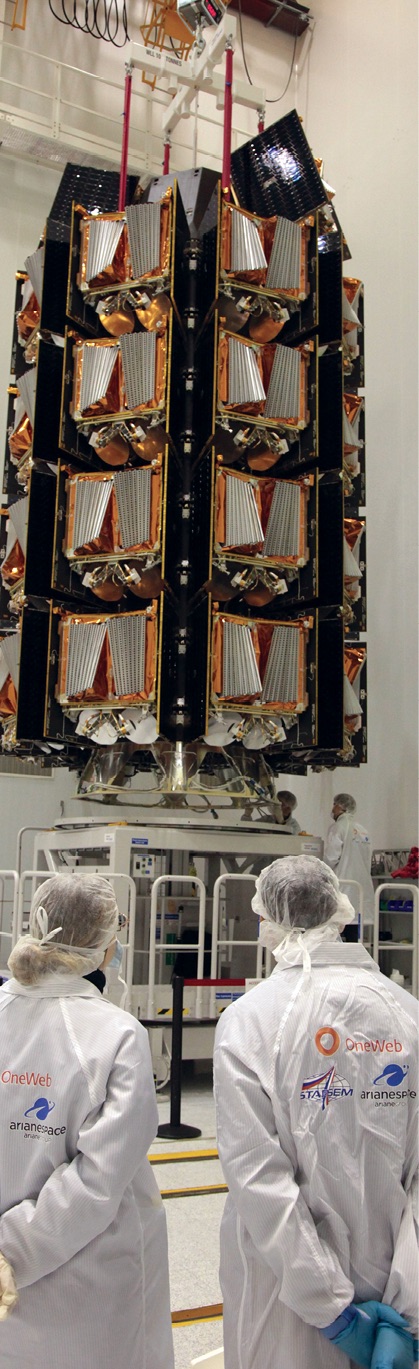

OneWeb completed the launch of six test satellites in 2019 and this February launched an additional 48 of the total 600 satellites it now plans for its new constellation. It has a request pending to launch another 1,260 spacecraft. OneWeb said that this year it would demonstrate its commercial services and, in the Arctic, begin offering commercial services. It expects to achieve global coverage in 2021.

Telesat, already a long-established space firm based in Canada, is planning a constellation of 298 satellites flying in a combination of polar and inclined orbits. Each of the interlinked satellites has four phased array antennas that allow the firm to dynamically reallocate capacity, making it possible, for example, to boost transmissions when flying over high-traffic areas like extensive server farms.

The constellations offer a number of advantages. They all plan to operate in low Earth orbit (LEO)—far closer to the planet’s surface than telecom satellites in geosynchronous orbit—yielding very low latency (the time between when a signal is sent from one ground location through a satellite to another point on the ground). Recent tests by Telesat demonstrated that a signal could make the trip in 18 to 40 milliseconds as long as the start and end point are both in the same satellite’s field of view. The firm said in October that its tests showed its service could support 4K video conferencing, live video streaming and live calling over mobile devices.

Dallas Kasaboski, a senior analyst at Northern Sky Research (NSR), believes that, from the satellite firms’ point of view, supporting data transmission to and from agriculture drone operations is becoming workable from both business and technical perspectives. Cambridge, Massachusetts-based NSR has been following the deployment of mega-constellations and in June released the second edition of its report on the sector, “Satellite Constellations, A Critical Assessment.”

“Whether we’re talking about high or low bandwidth communications, the good news is that there’s so much development—there’re so many players looking to launch infrastructure—that it’s a good case for them,” Kasaboski said.

MOVING DATA

One advance enabling transmissions to these new low-Earth orbit satellites is the development of new types of small, phased array antennas that can follow fast-moving spacecraft across the sky without physically moving their substructure. Starlink and OneWeb are working on their own solutions and there are 23 antenna manufacturers developing new approaches, Kasaboski said. This group includes Phasor Solutions, which has electronically steerable antennas based on dynamic beam-forming technologies, and Kymeta, which introduced an antenna based on meta-materials in 2017. Kymeta had its technology installed at a solar farm, which used a data setup that is likely to be similar to how drone image transmissions would be handled initially, said Kasaboski.

“The data from the solar farm infrastructure was being channeled to a central office or central area, which was then communicated by this antenna up to satellite communication—so giving that really rural area a capacity for communication that it didn’t have before,” Kasaboski said.

In the beginning it will be much less technically challenging and far less expensive to use this approach, gathering the data at one stationary point and then transmitting it to the satellite. But that doesn’t mean the transmit point has to be permanently fixed. Kymeta has a flat antenna small enough to fit on the roof of a car. A specially equipped van, motorhome or Winnebago could be a hub for gathering data—either directly transmitted from the drones or downloaded from the UAS after each flight—and then uploading it to the constellation.

“I wouldn’t see any reason why you couldn’t transmit data over those commercial systems to whoever wanted to do the analysis of it,” said Robert Stamm, the manager for Raytheon’s ground-based drone detect and avoid (GBDAA) efforts. Raytheon is developing SkyVision, a GBDAA system that will help make beyond-line-of-sight drone flights possible. His team has developed a mobile, Winnebago-based system to support SkyVision.

The bottom line, based on what is known so far, is that it should be possible to upload 50 GB of data from a stationary antenna to a server farm over one of the new constellations during a two-to-three-hour period, Kasaboski estimated. Telesat believes it can do the job much faster.

“Well, that is a humongous file size considering the average household uses 50 GB in an entire month!” said Erwin Hudson, the vice president of Telesat LEO, in a statement. “BUT, we are designing user terminals to support 1 Gbps speeds. So in this example, we could transfer one GB every eight seconds. Full file size would be 50 x eight seconds, for a total of 400 seconds—just under seven minutes.”

Once the data is uploaded, where can it go? Pretty much anywhere one wants it to, said Kasaboski.

The most direct “bent pipe” approach is to have the satellite take the upload and then beam it back immediately to a server farm that is already in its field of view. Based on the findings in a recent paper analyzing the FCC filings of the three firms “that field of view is fairly wide and the ground station could be hundreds of kilometers if not thousands of kilometers away,” said co-author Bruce Cameron, director of the System Architecture Group at the Massachusetts Institute of Technology.

If that is not enough, some the satellites will be able to pass along the data while in orbit (Telesat spacecraft will be interlinked) or carry the data and then download it to the computer center when they are overhead, said Kasaboski. If need be they can download it to an interim node in the firm’s ground network, which can then automatically retransmit it to another satellite headed in the right direction to get it to the right place. With thousands, perhaps tens of thousands, of satellites in orbit the right place can be just about anywhere.

TIME AND MONEY

Kasaboski said at least one full constellation should be launched and operational in the next two to three years. In another two years both the satellites and the ground system network will be in place to be able to handle at least the more standard applications and practices.

In the case of agricultural drone images, he said, it will be possible in four to five years to upload a file from a non-moving place and have it bounce around to where it needs to be, and then have it be downloaded. Being able to get data uploads from a moving antenna will take seven years or more, he estimated.

But will it be affordable? According to Kasaboski the price for a site able to send 50 GB/day currently would be a minimum of $15,000 per month, just for the connectivity. But that’s today, he said; prices will drop as competitors emerge and higher efficiency networks are established.

“As these constellations are launched and more competition on the antenna front is happening,” said Kasaboski, “the prices will go down, the coverage will go up and the throughput—the amount of data that you can send—will also become more favorable.”