As defense manufacturing confronts global instability a new generation of companies is reshaping the U.S. industrial base with speed, software and decentralized production at its core.

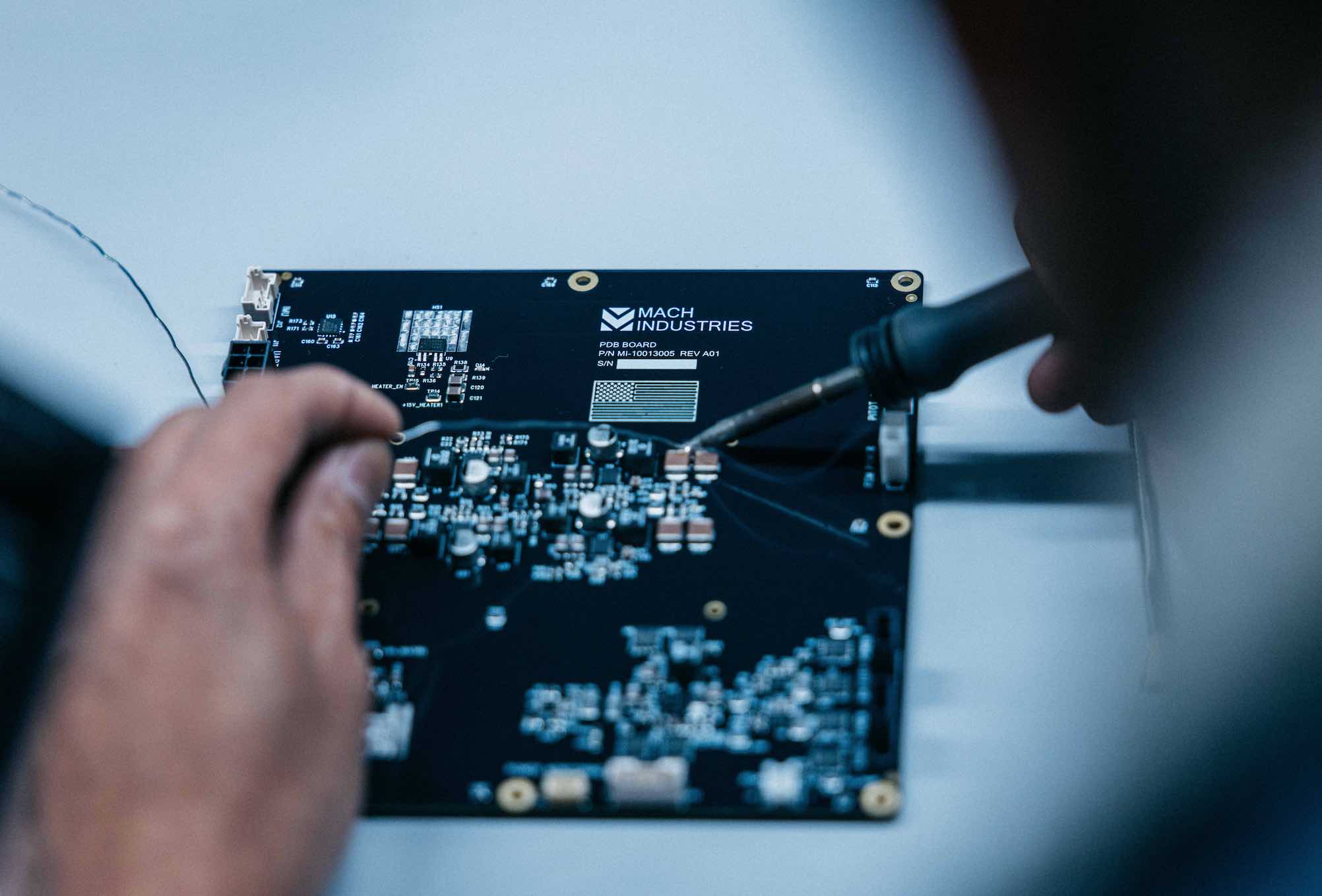

Ethan Thornton is walking through Mach Industries’ cavernous 115,000-square-foot facility, and the floor is alive with movement: engineers huddled around prototype drones, racks of parts cycling through assembly, raw materials disappearing into machines that produce finished hardware in hours, not months.

Mach Industries’ Forge: Speed, Flexibility and a New Philosophy of Production

“I’ve always been super passionate about military and defense,” Thornton says. “It’s pretty clear how huge of a change unmanned systems are going to be. Warfare and manufacturing are going to be done entirely differently.”

Thornton launched Mach while still in college, building it around a single principle: the United States must be able to field advanced hardware faster, more flexibly, and at greater scale than any adversary. If the Cold War was won with brute industrial might, he believes the next war will be decided by speed, software and a reimagined supply chain.

Over 50% of defense suppliers have vanished since the Cold War, according to the Department of Defense. What remains is brittle: lead times for precision munitions stretch beyond two years; military depots run on infrastructure older than the people who staff them. In a 2023 McKinsey survey, 70% of U.S. manufacturers named supply chain resilience their top priority. The DoD has responded by allocating $2.3 billion in FY2024 for industrial modernization, with an emphasis on re-shoring critical components and decentralizing production.

Mach Industries is positioning itself as the sharp edge of that effort. Its Forge manufacturing network is a decentralized model designed for wartime resilience. The system allows for small, replicable production sites capable of switching product lines in days, not months. It’s a radical departure from traditional defense contracting, and central to Mach’s partnership with Israeli firm HevenDrones, whose hydrogen-powered UAVs will be produced in Mach’s U.S. facilities.

“If you can take that $100 million asset and break it into many $1 million assets,” Thornton says, “if you can take the ultra-large factory and replicate its processes across 50 smaller factories, you end up being a lot more survivable and adaptive.”

This isn’t theory. It’s happening now. In Ukraine, decentralized manufacturing hubs are pumping out over 30,000 FPV drones per month at a unit cost under $500. Those drones are routinely destroying tanks worth 2,000 times more. Embedded AI models now enable semi-autonomous targeting with microcontrollers that cost less than a meal.

Thornton sees the same logic applying to Mach’s flagship platform, Viper: a vertical takeoff and landing (VTOL) strike aircraft with a turbojet engine, no runway requirements, and mission flexibility that spans from one-way attacks to reusable surveillance. “That VTOL architecture is applicable both for one-way systems and reusable systems,” he says.

Speed is the point. A recent revision of Viper went from concept to flight in just 14 weeks. Mach does its own avionics, propulsion, RF—everything in-house. Shared tooling across platforms allows them to borrow parts and collapse design cycles. Thornton wants to get development timelines down to weeks. And he’s thinking much bigger.

“Pre-WWII, a single spring factory for feathering props got flooded, and it nearly crippled the Air Corps,” he says. “That’s the kind of fragility we can’t afford today.”

This is why Mach remains hardware-first and software-agnostic. They write their own system-level code—guidance, denied navigation, RF—but they’re not building battlefield management tools. “We want to work with whoever the best players are,” Thornton says. He envisions a future of unmanned systems that can be launched from anywhere, built quickly and replaced faster than they can be targeted.

Arsenal-1 and the Hyperscale Defense Model

Christian Brose, Chief Strategy Officer at Anduril Industries, echoes this urgency. In testimony before Congress in late 2024, Brose warned: “The industrial base that helped win the Cold War no longer exists, and the one that remains is not built for the kinds of conflicts we are likely to face.”

Brose’s diagnosis is stark. In classified war games, the U.S. runs out of long-range munitions in under a week. Ukraine expended in six months what took America a decade to produce. The existing industrial base, he argued, is too slow, too expensive and too centralized to win in a high-intensity fight.

Anduril’s response is Arsenal-1, a hyperscale, software-defined factory in Columbus, Ohio. Unlike traditional defense manufacturing, which often involves lengthy timelines, rigid production lines and heavy reliance on bespoke components, Arsenal-1 is designed around flexibility, standardization and software-first integration. Rather than producing one platform at a time in siloed facilities, Arsenal-1 will leverage a common set of commercial manufacturing tools and infrastructure across all products—from drones to sensors to underwater systems—enabling modular production that can pivot quickly to meet emerging demands.

The core of this strategy is Arsenal OS, a digital backbone that unites design, development, testing and mass production under one system. This platform-centric approach allows Anduril to dynamically reallocate capital, workforce and materials across production lines in real time—capabilities that are virtually impossible under legacy models. It reflects a fundamental shift away from the defense industry’s traditional preference for complexity and specialization toward scalable simplicity and responsiveness.

Slated to open in 2026, Arsenal-1 will produce tens of thousands of autonomous systems annually, with the flexibility to shift products on demand. It’s backed by nearly $1 billion in private capital and will create over 4,000 jobs. The site, located near two 12,000-foot runways, allows rapid deployment of finished systems.

“We are working to move from large-scale to hyperscale production,” Brose told lawmakers. Arsenal-1 integrates design, development and production into a single digital ecosystem. Nearly 90% of Anduril’s products use commercially available components, reducing dependency and slashing lead times.

Ohio leaders see Arsenal-1 as a generational pivot. Governor Mike DeWine called it a turning point: “The future of American air power will be made in Ohio.”

Maritime Autonomy and the Rise of Port Alpha

Another signal of that future is emerging on the water. Saronic Technologies, fresh off a $600 million Series C funding round, plans to build Port Alpha, a next-generation shipyard to produce unmanned surface vessels at scale. Like Arsenal-1, it aims to do for naval autonomy what Mach and Anduril are doing in the air.

“We will take the same approach with Port Alpha, designing a shipyard from the ground up to produce at a speed and scale not seen since World War II,” said Saronic CEO and co-founder Dino Mavrookas. His vision includes medium- and large-class autonomous ships, produced in volume and at a fraction of the cost of traditional warships.

This surge in decentralized, software-driven production isn’t just about economics. It’s about survival. A 2018 DoD report identified five major threats to the defense supply chain: foreign reliance for critical materials, manufacturing shortfalls, workforce attrition, inefficient procurement and cyber vulnerabilities. China remains the primary source for rare earths essential to modern weapons. Many suppliers are sole-source. Cyberattacks target small subcontractors.

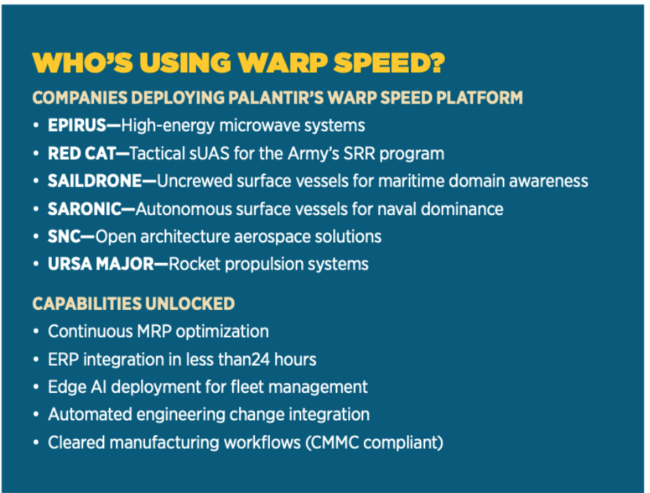

Palantir’s Warp Speed and the Software-Defined Supply Chain

Palantir Technologies, long known for its role in battlefield intelligence, has also joined the industrial reformation. In addition to working with large defense contractors, the company recently announced six new customers for its Warp Speed platform: Epirus, Red Cat, Saildrone, Saronic, Ursa Major and SNC. These companies represent a cross-section of the new defense-industrial movement—fast, autonomous and digitally native.

“We designed Warp Speed to enable faster, safer and more efficient production of formidable machinery that is critical to America’s leadership—from sea vessels, to drones, to propulsion systems,” said Emily Nguyen, Palantir’s Head of Industrials. “Epirus, Red Cat, Saildrone, Saronic, SNC, and Ursa Major represent the most visionary leaders, technologies, and manufacturing operations—and we are extremely proud to enable the companies who share our sense of responsibility for the power of American production.”

Epirus, maker of the Leonidas high-energy microwave system, is using Warp Speed to automate engineering changes and accelerate delivery of its counter-electronics platform. “Speed, agility and precision are critical in delivering transformative technology at scale,” said Epirus CEO Andy Lowery.

Red Cat is leveraging Warp Speed to increase throughput for its ISR and strike-capable small drones. The company recently won a U.S. Army contract for the Short-Range Reconnaissance (SRR) program, which aims to field a rucksack-portable, rapidly deployable drone for dismounted soldiers conducting day or night reconnaissance in GPS-denied and contested environments. The program is central to the Army’s broader strategy of providing small units with ISR capabilities that traditionally required larger platforms or external support.

Red Cat’s Teal 2 system was selected for its advanced imaging capabilities—including thermal and low-light sensors—rugged design, secure communications and modular payload integration. The drone is built to meet U.S. Army Group 1 UAS standards, offering frontline operators a reliable and easy-to-deploy ISR solution that can be fielded quickly and maintained in austere environments. Its inclusion in the SRR program represents a strategic milestone for Red Cat and signals increased demand for domestically manufactured, mission-specific drones that can scale with operational tempo.

“Warp Speed enables us to optimize our production, supply chain and logistics with speed and precision so we can deliver mission-critical technology to those who need it most, when they need it,” said Jeff Thompson, CEO of Red Cat, in a press statement.

Saildrone, a pioneer in autonomous maritime awareness, is using Warp Speed to integrate production planning and deploy AI capabilities across its unmanned surface fleet. CEO Richard Jenkins described it as “transformational for Saildrone and our ability to rapidly scale manufacturing with minimum overhead.”

Saronic, which is already scaling production of four classes of autonomous surface vessels, is using Warp Speed to improve material planning and engineering change processes. “By partnering with Palantir and integrating Warp Speed into our operations, we are further accelerating our ability to bring cutting-edge maritime solutions to the fight,” said Doug Lambert, co-founder of Saronic.

SNC, a global aerospace and defense company, is using Warp Speed to coordinate program management, engineering and manufacturing through AI-enabled collaboration and continuous digital feedback loops.

Ursa Major, a next-generation propulsion company, is relying on Warp Speed to exponentially increase production capacity for its solid and liquid rocket motors. “We must aim to produce units in hours instead of days or weeks,” said CEO Dan Jablonsky.

The TITAN program, for which Palantir is prime contractor, brings together technologies from L3Harris, Northrop Grumman, Anduril and others into a first-of-its-kind AI-enabled sensor fusion system. Warp Speed underpins delivery and integration across the program’s multi-organization footprint.

Since its launch, Warp Speed has introduced key capabilities such as MRP Speed for continuous material optimization, integration with legacy ERP systems and secure AI edge deployment in DDIL environments—all critical for maintaining operational tempo in contested scenarios.

Palantir has been tasked with enabling full-spectrum situational awareness from the factory floor to forward-deployed operations.

Blockchain is being explored for traceability, transparency and accountability in the defense supply chain. Lockheed Martin and the U.S. Air Force have piloted blockchain applications for logistics and asset management, using distributed ledgers to maintain tamper-proof records of parts, suppliers and chain-of-custody from origin to deployment. If widely adopted, blockchain could transform logistics by providing real-time visibility, detecting anomalies and dramatically reducing the risk of counterfeit components entering mission-critical systems.

Digital Traceability and Legislative Momentum

According to a 2020 Defense Acquisition University white paper, blockchain “could enable real-time verification of supplier identities and part authenticity at each step in the acquisition and delivery process,” thereby streamlining audits and ensuring compliance with federal standards. This level of digital provenance is particularly valuable in a defense environment where subcomponents can originate from hundreds of suppliers across several countries.

In an era of adversarial cyber campaigns targeting defense logistics networks, blockchain’s decentralized architecture provides a fundamentally more secure alternative to traditional, centralized databases. By distributing identical copies of the ledger across a network of nodes—rather than relying on a single source of truth—blockchain makes it far more difficult for an attacker to corrupt or alter supply chain data without being detected. Any unauthorized change to one node’s record must be validated against all others in the network, adding a powerful layer of integrity and fault tolerance.

This structure also mitigates risks associated with insider threats or the compromise of smaller subcontractors—often the weakest link in cybersecurity. For example, if a rogue actor attempts to insert a counterfeit part into the chain, the blockchain ledger would flag the inconsistency immediately because the component’s provenance cannot be faked across the validated network. This has particular relevance in the defense sector, where thousands of suppliers feed into the system and legacy systems often lack centralized oversight.

Access to the blockchain can be configured with role-based permissions, cryptographic signatures and audit trails that ensure accountability at every touchpoint—whether it’s a warehouse, assembly line or last-mile logistics hub. These features allow the DoD and prime contractors to enforce cybersecurity hygiene at the edge, even among vendors who operate without sophisticated IT infrastructures. Because it distributes data across multiple nodes, the system is less vulnerable to single points of failure or manipulation—a key consideration for small businesses and subcontractors that may lack enterprise-level cybersecurity.

Industry advocates have argued for integrating blockchain with existing ERP systems and digital twins, allowing logistics personnel to not only see where a part is, but understand how it fits into the larger picture of readiness, maintenance and mission planning. If combined with edge computing and AI, blockchain could enable predictive logistics models that reduce downtime, anticipate part failures and coordinate replacements before they interrupt operations.

While the technology is still in the experimental and pilot phase for most defense applications, companies like SIMBA Chain are working with the U.S. Air Force to integrate blockchain into asset tracking and inventory control. Defense primes have also begun building capabilities to audit supplier activity and inventory movement using blockchain-integrated dashboards.

We’re moving toward a future where every bolt, chip and firmware update has a traceable signature. That level of traceability isn’t just about efficiency—it’s about trust and national security. The 2025 National Defense Authorization Act may help. Section 849 directs the Secretary of Defense to incentivize contractors to identify and mitigate vulnerabilities across their entire supply chain.

“These are the times that countries need to adapt,” Thornton says. “Otherwise, we’re going to have an impotent fighting force in three decades. Across acquisitions, software, hardware and manufacturing—we all need to be working really, really hard to engineer the future our country needs.”