Methane, as a greenhouse gas (GHG), traps heat in the atmosphere and warms the planet. Capable of staying airborne for about 12 years, it accelerates climate change and acts as a precursor to health-harmful ozone at ground level.

The United States is one of the world’s top six methane emitters. More than 300,000 U.S. oil and gas wells and other sites alone emit methane. Then there’s pipelines. Energy facilities and related operations account for 30% of the country’s methane emissions.

As oil and natural gas companies face increasing environmental and social governance (ESG) pressure to be more environmentally conscious in their operations, many have turned to drones for their comprehensive methane solution.

A WIDE PLUME OF LEGAL REQUIREMENTS

In 1970, Congress passed the Clean Air Act (CAA)(42 U.S. Code Chapter 85). The legislation charged the Environmental Protection Agency (EPA) to establish national ambient air quality standards for common pollutants. Later amendments in 1977 and 1990 expanded the CAA’s coverage to the stratospheric ozone layer.

The CAA mandated the EPA to set Oil and Natural Gas Sector New Source Performance Standards (NSPS) for industrial categories that cause, or significantly contribute to, air pollution. In response, in 2016, the EPA published the national “Standards of Performance for Crude Oil and Natural Gas Facilities for which Construction, Modification or Reconstruction Commenced after September 18, 2015” (40 CFR Part 60, Subpart OOOOa), commonly referred to as OOOOa (or “QuadOa”).

For the oil and natural gas industry, OOOOa establishes emission control standards for me-thane production, processing, transmission and storage for sources constructed, modified or reconstructed after that 2015 date. It also requires said companies to submit annual compliance reports (via the Compliance and Emissions Data Reporting Interface (CEDRI)), as well as to maintain certain records.

This broad-sweeping regulation applies to various facilities, including well completions (for hydraulic fracturing and refracturing), wet seal centrifugal compressors, reciprocating compressors, natural gas-driven pumps, storage vessels, collections of fugitive emissions components at well sites and compression stations, equipment leaks at natural gas processing plants and sweetening units at natural gas processing plants.

The regulation (and several others) requires certain facilities to implement a Leak Detection and Quantification (LDAR) program to identify leaks through consistent performance testing, monitor-ing and reporting. According to the EPA, LDAR programs could reduce equipment leak emissions by 63% in some cases.

A few states also have their own methane regulations. Colorado’s 2014 directive preceded the EPA’s NSPS; it has a broader scope, covering all oil and gas wells, not just those created after 2015. Since the state regulation’s inception, the natural gas industry has performed millions of LDAR inspections.

Failure to comply with these rules can cost companies big. Enforcement actions can range from hefty civil finds to criminal prosecution. For example, in May 2020, Sprague Resources LP, the owner/operator of several New England petroleum storage and distribution facilities, paid $350,000 in civil penalties to the EPA and state authorities for “alleged violations” concerning oil storage tank emissions.

Not long after the Sprague settlement, in September 2020, the Trump-era EPA released short-lived rules to roll back methane and other emissions standards (see legal analysis on these changes at Harvard’s Environmental & Energy Law Program).

In a complete reversal, in November 2021, the Biden EPA proposed new regulations to expand methane emissions controls for new oil and gas facilities, with a goal of reducing these emissions by approximately 75%. These regs will also require states to develop methane reduction plans for the first time.

Simultaneous with this EPA rule-making, the administration unveiled its U.S. Methane Emissions Reduction Action Plan. Consistent with a Global Methane Pledge to reduce the world’s methane emissions by 30% from 2020 levels by 2030, it doubles down on emissions standards and promoted innovation and new technologies to assist with compliance.

Enter drones.

SNIFF, SENSE AND REFLECT

In addition to traditional hand-held inspections, a range of airborne technologies support methane leak detection. Traditional aircraft equipped with sensors can spot high emitters over wide spatial areas. Satellites can be used for larger emitters, regularly, across the global commons. Drones, however, are ideal for in-close high fidelity comprehensive leak detection.

For this reason, methane detection is the No. 1 use case for drones in the oil and gas industry. They are efficient for conducting regular and consistent surveys of facilities and equipment for emissions detection, localization and quantification. And they take human risk out of the equation.

Andrew Aubrey, Ph.D., former NASA engineer, co-founder and senior vice president of strategic partnerships of Austin-based SeekOps—creators of the award-winning drone sensor technology SeekIR®—notes that drones typically detect emissions in one of three ways:

• POINT SENSOR: A sniffer-type highly sensitive sensor provides direct measurements. It has to be in the plume, but can target specific gases and quantify emissions.These sensors can provide accurate quantification of both small and large leaks at close or long distances from a source.

• OPTICAL GAS IMAGING (OGI): This involves passive remote sensing of a signature gas, which is useful for larger leaks. It depends on thermal contrast and provides a quantitative analysis that relies on the shape of the plume. This tech is very good at detecting the source of the leak and is effective when used close to sources.

• LASER REFLECTIVITY: This is active remote sensing. It requires a reflective surface and focuses on larger leaks, which it can localize at long distances.

FLOGISTIX IN THE FIELD

Flogistix, a company that has been providing end-to-end emissions management and environmental solutions for more than a decade, recently incorporated drones into its operational model to pinpoint leaks. It uses all three of the above methods via a DJI Matrice 300 RTK.

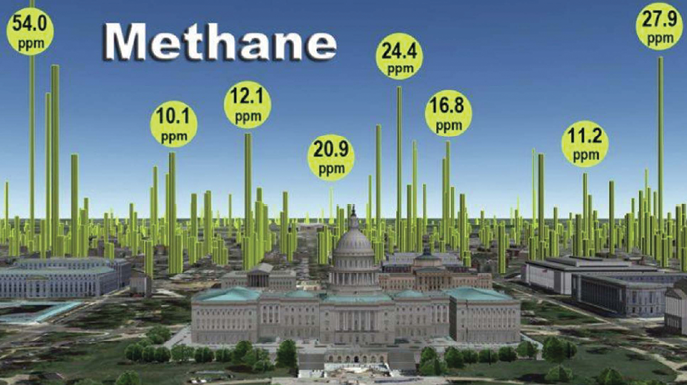

According to Zachariah Roppel, senior product lead at Flogistix, the Oklahoma City company’s use of the Sniffer 4DV2 air pollutant mapping device was its first venture putting a sensor on a drone. Users had to drive the drone straight through the plume, with the different shades along the flight path correlated to parts per million (ppm) of emissions. “The drone and its sensors visualized emissions that were happening all around us that we were otherwise oblivious to,” he said.

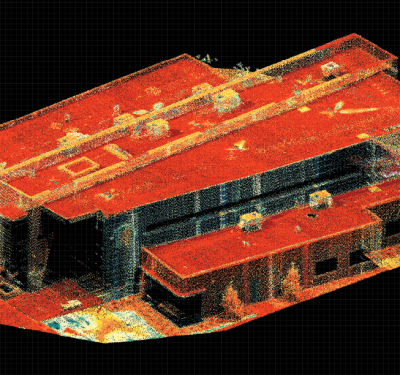

Flogistix also uses the OOOOa-certified Sierra-Olympic Ventus OGI (optical gas imaging) camera to capture emissions. The unit has a focal plane array of more than 20 different gases at a resolution of 640 x 512 and a 25 millimeter 4X optical zoom. It provides analog and digital outputs as well as GPS location marking. The team also uses the U10 UAV Based Laser Methane Leakage Detector, which is capable of detecting up to 5 parts per million as far as 100 meters away. This company also employs LiDAR, thermal, photogrammetry and other sensors, as needed.

“The drone is one thing. What you do with it is another,” Roppel said. Flogstix’s holistic solution, called AirMethane, includes not only the drone and various plug-and-play sensors, but also an IoT-based performance dashboard called Flux.

Flux can livestream data, including images and video, in real time, to client locations or Flogstix’s own operations center. The company’s remote pilots and certified thermographers can also upload all their flight data into the system to be later aggregated into a report. Flux also employs machine learning against historical data for deeper insights into long-term equipment perfor-mance and full scope emissions profiles.

THE WINDS OF CHANGE

As companies focus more on ESG, leak detection and accurate quantification of methane emissions are key efforts. Drones are already making a difference.

Roppel explained: “With drone data, we can collaborate with customers on the spot and get immediate feedback. Together, we can really come up with the solution they need.”

Dr. Thomas Fox, president of Highwood Emissions Management, a consulting firm in Calgary, Alberta, that evaluates, develops and deploys novel and intelligent methane strategies, agrees. “We are at the beginning of the revolution,” he said. “We are at the nexus of rapid innovation in measuring and abating methane emissions and a digitalization and data revolution that is moving us away from clipboards to more advanced ways of storing and analyzing information.

What’s next? Aubrey thinks BVLOS operations will kick things up a notch. “As drones get longer duration and more endurance, they will capture more and more of the methane use cases,” he explained. “Think about pipeline leak detection. BVLOS will open up using drones for what manned aircraft are currently doing.”

Until then, UAS will be sniffing, protecting us all the while.