A deep dive on the background and current state of play for DIU’s Blue UAS and AUVSI’s Green UAS manufacturer programs.

Some believe the passage of, and proposal of even more, anti-Chinese drone laws at both the federal and state levels will open the floodgates for made-in-the-USA autonomous drones and components. Considering that Chinese drones account for more than 75% of the U.S. drone market, many assumed banning them would generate opportunities for U.S.-made drone OEMs, and that the Defense Innovation Unit (DIU) Blue program was the yellow brick road to Oz. Where does Blue stand now? Are there other available avenues for OEMs to find their products a home in government agencies? Find the answers to these questions and more as we travel through the past and gaze into the future for the various paths to autonomous drone deals with the government.

Update: On April 23, at AUVSI’s XPONENTIAL keynote, DIU and AUVSI announced a new Memorandum of Understanding for increased collaboration. The MOU creates a process for drone component manufacturers holding Green UAS certification to share their data directly with DIU, with an aim to potentially include Green certified components on DIU’s Blue UAS Framework list.

THERE’S NO PLACE LIKE HOME

DIU’s Blue program, which generates a “robust roster of policy approved” commercial drones and interoperable components and software, sprung forth from Section 848 of the FY20 National Defense Authorization Act (NDAA).

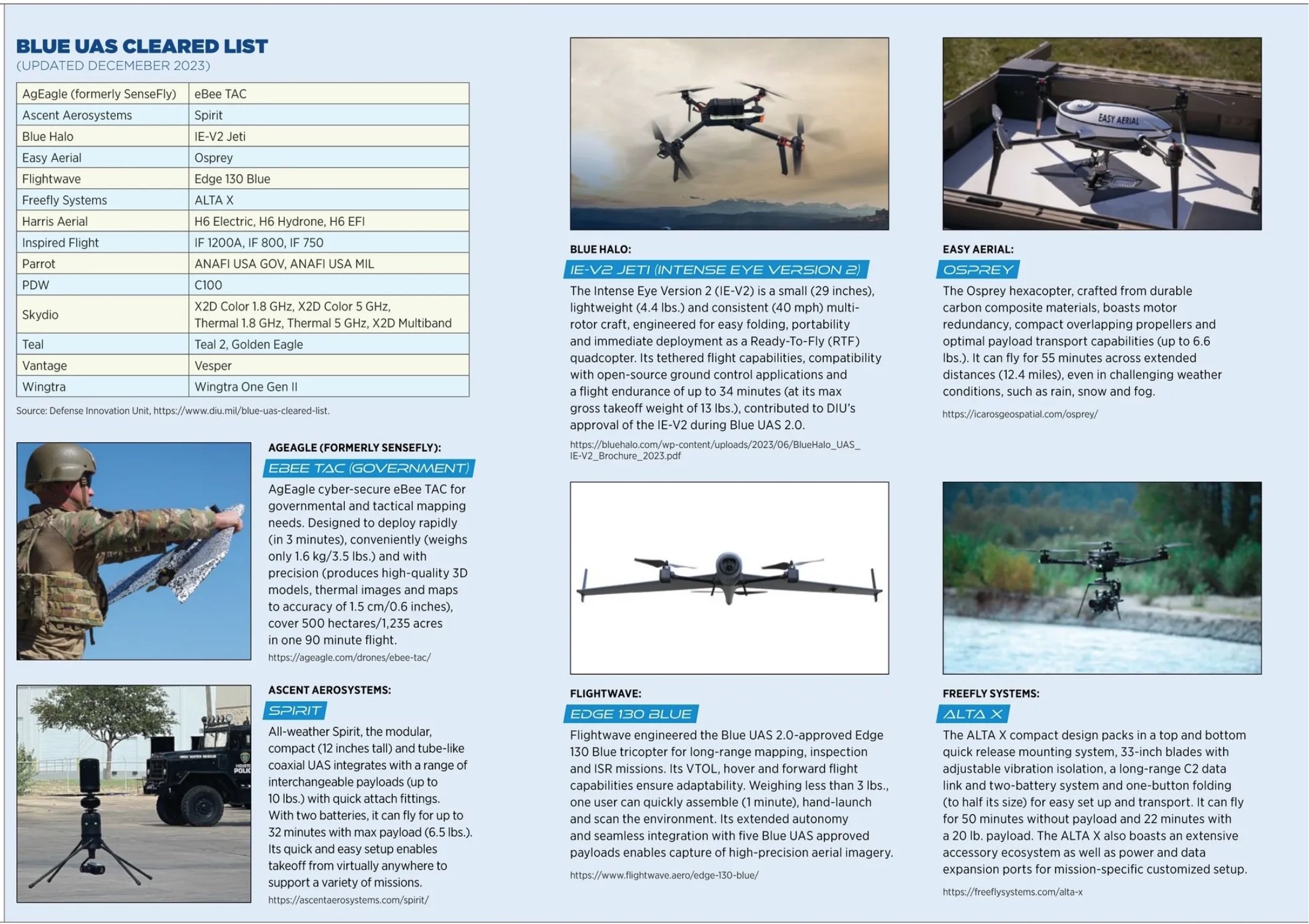

That NDAA legal ban arose just as DIU was in the midst of signing on five drone OEMs as part of the Army’s Short Range Reconnaissance (SRR) program. Toward the end of 2020, the SRR companies (Parrott, PDW, Skydio, Teal and Vantage) became the first OEMs to have drones vetted on the Blue UAS Cleared List. Systems added to this list do not require a DOD exception to policy to procure or operate because they undergo a cyber-security evaluation, an NDAA-compliance check and DIU provides them all DOD-required authorization to operate documentation.

During this initial Blue 1.0 process, the need for compliant components, sub-components, modules and software spurred the creation of the Blue UAS Framework. DIU cleared companies like ModalAI, creators of the VOXL family of autopilots, and Doodle Labs, makers of smart radios, as some of the first Framework-cleared tech.

Once granted Blue UAS approval, systems, accessories and payloads can be included on the General Services Administration (GSA) schedule.

Blue UAS 2.0 arose in 2021, when government partners sought a wider variety of drone sizes, capabilities, price points and flight modalities (see previous IUS coverage on Blue in the Oct/Nov 2021 issue). About two years later, in early January 2023, DIU announced the formal closeout of Blue UAS 2.0. Thirteen different drones from 10 OEMs made the cut.

According to the closure announcement, “Blue UAS 3.0 is in development and details will be released in the coming months.”

More than a year since then, DIU has not launched it. Don’t expect Blue 3.0 UAS anytime soon.

WAIT A MINUTE FELLAS

Trent Emeneker, a contractor who has been running point for the Blue program under DIU’s Autonomy portfolio for a year, said Blue has evolved into more of a continuous bottom up, end-user demand-responsive process.

End-users must back their demands with funding, however, before DIU can formally act on these requests. Emeneker explained, “We need to work with our partners, but our partners need the funding to solve the problems they have. Unfortunately, DIU is not financially resourced to add any platforms and we would not want to do that unilaterally because the end-user knows what they need best.”

Across the board, money has been tight for the DOD. This year alone, congressionally mandated spending caps will result in $10 billion cuts for departmental programs. This has impacted DIU’s Blue UAS activities.

That said, even when money shakes loose for drones and components, the various end-users have their own internal policies, funding and requirements processes. For its part, the DOD lacks a holistic, department-level owner for both drone and counter-drone needs. So, DIU gets hit from all sides, formally and informally.

When any DOD partner reaches out for help for formal tech solutions (think program of record), DIU can leverage its Commercial Solutions Opening (CSO) process and officially seek competitive proposals for innovative solutions.

If a partner sends DIU an informal request about tech, it takes on more of a consultative role by helping to locate matching best-in-class commercial solutions through traditional market research. Emeneker acknowledged his team “starts with what they already know from our broad industry network and connections across academia, industry and the DOD to find the best fit for each unique problem brought to them for these searches.” He elaborated, “We have a broad network across the industry and leverage that to help end users find the best solutions.” This gives companies in the Blue ecosystem a leg up, if their tech happens to match partner needs.

For OEMs not on the Cleared List, DIU has no alternative behind-the-curtain list. Emeneker emphasized Blue is one of three pathways into DOD sUAS sales, with programs of record (POR) and Exceptions to Policy (ETP) being the other two. For virtually all other sales of any product within DOD, the only options are via a POR or ETP, which is one of the ways Blue UAS is unique.

“Through no fault of their own, many companies claim they are NDAA compliant when they are not,” Emeneker noted. “Because of the very tangled supply chain facing companies, we haven’t found a good way to know what’s truly NDAA-compliant until we dig deeper through physical teardowns.” DIU doesn’t have the resources to create a standing application for NDAA-compliant tech and then also validate them all, just in case a user demand arises.

Enter: The Association for Uncrewed Vehicle Systems International’s (AUVSI) Green Program.

A HORSE OF A DIFFERENT COLOR

Last May, AUVSI rolled out its Green UAS program to open the door for companies that had been unable to get into DIU’s Blue UAS program.

Michael Robbins, AUVSI president and CEO said, “We saw other federal agencies, commercial entities, state and local governments all wanting to buy Blue UAS drones. But Blue was always intended to be a much narrower DOD program. DIU was not funded to take on the larger demand signal of vetting drones and components. So, we worked very closely with DIU to take what they had built with Blue and bring it into the commercial realm, while still offering anybody who goes through Green the opportunity to become Blue.”

The Green UAS program mirrors Blue requirements and includes additional components to enable it to withstand changes in the evolving threat environment. Green vetting includes a supply chain risk management review as well as a cyber penetration test. Any company, including OEMs originating outside the U.S. and non-members, can apply to participate.

DIU’s Emeneker lauded the Green UAS effort. “Green UAS is doing what Blue does, from the point of view of industry standards,” he said. “I’m a fan of it. I trust the work they are doing. It is a way for existing commercial companies to get a real badge for no-kidding NDAA compliance.” He also acknowledged that in the informal realm of partner needs, his DIU team would look to drones certified under the Green program.

Robbins added, “Green UAS drones won’t automatically have that DIU authority to operate. But if a Green company finds a DOD sponsor to support them in the DIU process, they should be able to turn Blue more easily and rapidly than someone without our credentials.”

In the year since its inception, only one drone, Skyfront’s Perimeter 8+, has attained Green UAS cleared drone security certification. Fifteen other companies have their drones in the Green UAS pipeline for approval.

“Many companies have faced challenges with the time commitment and resources it can entail to achieve the level of cyber security verification required, especially given the nascent state of the industry we’re operating in,” explained Casie Ocaña, director of Trusted Programs for AUVSI. “We’re looking at partnerships and process improvements that will help reduce the cost and internal applicant resources required to get certified in the Green UAS process without sacrificing the integrity of the certification.”

With these changes to help streamline the process over the past few months, and its continuing work with in-process applicants and prospective companies, AUVSI projects it will have a few more to move to the cleared list in short order.

OTHER YELLOW BRICK ROADS

GSA represents just one of numerous purchasing avenues accessible to the federal government. The NDAA, EO and other relevant policy constraints regarding the acquisition of drones from foreign adversaries do not influence procurement methods for the DOD or any other entity.

For federal government procurement of commercial drones and components, various options remain available. Production-Other Transaction (P-OTA) agreements enable a streamlined process for subsequent production contracts after successful prototype completion, offering built-in sole source justification. Within the DOD, organizations can opt to initiate their own P-OTA with a selection from the range of Blue UAS options or allocate funds to procure quantities from existing P-OTAs sponsored by other DOD entities.

The Defense Logistics Agency’s (DLA) Tailored Logistics Support Program provides avenues for procurement through user contracting officials.

Finally, the Army’s Common Hardware Systems (CHS) contract vehicle also facilitates the acquisition of Blue Listed platforms, which further expands the range of options for government purchases.

Partnering with resellers and distributors who have access to these and other similar state-level contract vehicles could provide companies with even more opportunities. For example, Carahsoft, a multi-billion dollar leading trusted government technology solutions provider, offers its partners access to a significant number of contracts across the government space to leverage as an onramp vehicle.

At the federal level, Carahsoft takes advantage of three crucial government-wide procurement contracts: various GSA award schedules and the GSA Multiple Award Schedule (MAS) contract, which allow for the inclusion of drones and associated products; the NASA Solutions for Enterprise-Wide Procurement (SEWP) contract, recently expanded to cover drones and related software; and The Information Technology Approval System (ITAS) contract, a Computer Hardware, Enterprise Software and Solutions (CHESS) contract managed by the Army. These contracts are open for use by any federal agency in both defense and intelligence sectors as well as tribal organizations.

Similarly, a few states have their own state-specific GSA-like schedules, in which Carahsoft participates. California’s Multiple Award Schedules (CMAS) contract mirrors the federal GSA schedule. Similar arrangements exist in New Mexico, Seattle and several other locations.

State and local governments often also have cooperative purchasing agreements, through which state, local government, or educational institutions can purchase drones. The primary ones include National Association of State Procurement Officials (NASPO) accessible to about 38 states, and the OMNIA Partners contract, available to all state and local governments.

Carahsoft continues to grow its robotics and autonomy offerings. Lacey Wean, Carahsoft’s director of autonomy and robotics said, “For this vertical, we initially brought on about five partners manufacturing U.S.-made or Trade Act Agreement (TAA) compliant drones.” She continued, “Those few quickly turned into 10 and then again into 20.”

In addition to hardware, Carahsoft autonomy partners create geospatial and imagery processing software, provide data management and analytics services with AI/ML functionality, provide cloud-based workflow solutions that securely store data as well as training and enablement companies that help ramp new drone programs.

“This list continues to grow,” Wean noted, “and we’re always looking for new innovative solutions and partners that we can bring to our government customers.”

YOU’VE ALWAYS HAD THE POWER…YOU JUST HAD TO LEARN IT YOURSELF

These are but a few of the ways to secure government deals, both inside and outside of the Blue UAS program. The aperture keeps opening for an even wider variety of potential tech providers to work with the government.

The Green UAS program, for example, plans to roll out additional offerings for other types of uncrewed systems, including larger drones and automated cars and trucks. “Focusing on smaller drones is just the beginning for us,” Robbins said.

As government tech users continue watching and learning from real world events, such as in Ukraine, Syria, the Red Sea and others, they will also undoubtedly pass some of those requirements to DIU.

For example, DIU just recently posted a Blue UAS Framework solicitation seeking commercial solutions to enable Group 1 and 2 small drones and other small uncrewed vehicles to communicate in contested electromagnetic environments (think jamming, spoofing and other interference).

Emeneker expects to see even more needs for Blue Framework enabling components and software. “We see a lot of future opportunities in the Blue UAS Program,” he said. “We need to create a developer ecosystem of modular open systems approach [MOSA] hardware, software and other platforms that can work with or in a variety of other platforms to solve the problems that we see on the battlefield.” Some of those problems include navigation in contested environments, operating one to many and countering drones on the battlefield.

“UAS and counter-UAS go together. They are yin and yang. That’s why counter-UAS is also part of DIU’s Autonomy portfolio,” Emeneker said.

Keep your eyes open for more requests for tech in the government space. At the end of the rainbow sits a pot of potential government deals where OEMs in the autonomy space can find a home. Autonomy ecosystem companies, large and small, have the ability to travel down roads of many colors that can lead to lucrative government deals.