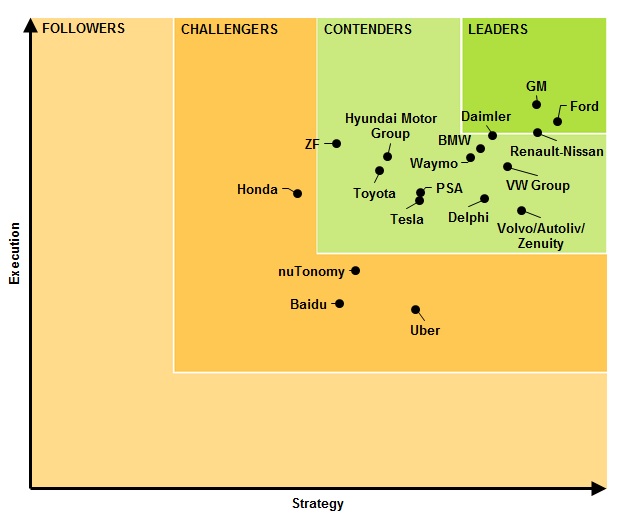

A well-publicized industry report, released earlier this month, indicates that Detroit has the lead on Silicon Valley companies when it comes to autonomous vehicle development. Navigant Research’s report said Ford, GM and the Renault-Nissan Alliance were the top three vendors testing autonomous cars.

The report may ruffle feathers in Silicon Valley as it lists Google’s Waymo unit tied for seventh with Volvo. Google has been the most-publicized of the companies in Silicon Valley testing autonomous vehicles for years.

The report said that automated vehicles are reaching a high level of maturity that will enable initial consumer deployment. “Several [companies] entered this market recently but rapidly moved into contention through acquisitions, investments, and strategic hiring of key personnel. Others have been working on automated driving technology for decades,” the report said.

This Navigant Research Leaderboard Report examines the strategy and execution of 18 companies developing automated driving systems. They list these companies as their top autonomous vehicle vendors: 1. Ford; 2. GM; 3. Renault-Nissan Alliance; 4. Daimler; 5. Volkswagen Group; 6. BMW; 7. Waymo (tie) 7. Volvo/Autoliv/Zenuity; 9. Delphi; and 10. Hyundai Motor Group.

Detroit has been buying up Silicon Valley autonomous vehicle startups to enhance their vehicle testing capabilities and options. However, some see reports of Tesla’s recent higher valuation than Ford as an example of a future industry trend.

On the other end of the spectrum, a new report from Frost & Sullivan says that more than 1,700 startups will disrupt and transform the automotive industry. While much of the study is based on the connected supply chain, IoT integration and mobility-as-a-service, it says connected and autonomous vehicles will be a big part of an $82 billion industry.

“New business model will consider data, connectivity and customer centricity along with cybersecurity,” said Frost & Sullivan Mobility Senior Consultant Sriram Venkatraman. “By 2020, Chief Digital Officers will steer the strategic and digital initiatives of OEMs across luxury and economy brands.”

Somewhere in the middle, and concentrating on automated technology, is Strategy Analytics’ new report, “Autonomous Vehicles and Safety Mandates Raise Demand and Performance in Automotive Radars.” The report outlines recent developments in autonomous vehicles and new “soft mandates” from safety agencies, such as Euro-NCAP, which are raising requirements for enhanced resolution and 360-degree sensing, the company said. “This will increase demand for automotive RADARs as well as bring about the introduction of new technologies, such as RF CMOS (Radio Frequency-Compound Metal Oxide Semiconductor),” according to the report. “This technology is used in the NXP Dolphin chip set that Hella will use in its fifth generation short range radars.”

“This enhanced capability is what is required by autonomous vehicles, along with corner or surround radar concepts that provide redundant sensing, on top of cameras and LiDARs, and in adverse weather conditions,” said Kevin Mak, Strategy Analytics Automotive Practice senior analyst, in a prepared statement. “But with this increase in performance comes the challenge of processing and transmitting larger rates of data, which can pose a dilemma on how auto makers design their vehicle architectures in the run-up towards autonomous vehicles.”