Gains Analytics and UAV Capabilities, Expanded Footprint

Photo courtesy of DroneBase.

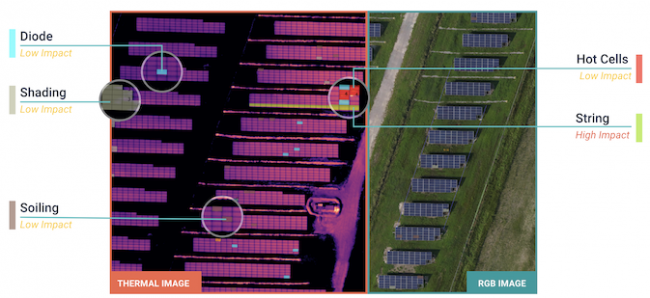

DroneBase, a Santa Monica, California supplier of intelligent aerial imagery, recently announced its acquisition of India-based AirProbe, which provides drone inspections of solar panels and artificial intelligence (AI)-enabled analytics. The resulting organization will have additional AI and UAV capacity and an expanded global footprint.

“My mission [at DroneBase] is to build up a robust global operation,” said Mark Culpepper, a former SunEdison executive who is now general manager, global solar solutions, for DroneBase. “As we did that, our big questions were: a) ’Who is out there with interesting technology and a good business footprint’ and b) ‘How will their technology help us to continue to scale up our operations?’ AirProbe was a uniquely good fit.”

AirProbe describes its offerings as “turnkey and aerial data analytic solutions for [the] complete PV asset lifecycle,” and DroneBase saw the company as an active potential partner. “They have a really good complementary technology, they’ve made big investments in their AI and machine learning tool chest, and they have clients in Asia, Pacific and the EMEA (Europe, Middle East and Africa),” Culpepper said.

DroneBase, despite its name, does quite a bit of work on high-density solar plant inspections using manned aircraft, especially in North America, noted Culpepper. “The tool chest from AirProbe,” in contrast, “is really optimized around UAVs,” he said. “So, when we looked, we saw a really great fit. We wanted a strong UAV solution,” he added, “both for emerging markets that don’t have high-density installations, and in North America for spot checks and on-demand inspections.”

Benefits and Challenges

AirProbe’s proprietary AI, Culpepper noted, significantly reduces the time needed to analyze aerial inspection data by up to 50%. “That’s much faster than we were doing before,” he said, adding that DroneBase’s actionable reports allow solar owners, operators and financiers to quickly fix anomalies and defects. He said they expect to see to see results of that time savings in Q1.

As to how the merger occurred, “We approached them,” Culpepper said. “They hadn’t been looking, but there was a pretty clear recognition as soon as we began our conversations that there was a good fit here. The teams are really well aligned culturally in terms of how to address customer needs, how technology can be applied and how client satisfaction is important.”

The last year, with COVID affecting both companies, was a particularly challenging time to work out the details. “COVID was really the sand in the gearbox for us on this transaction. You literally couldn’t sit down with people, and we were very dependent on each organization to find their own dynamic and make sure the right information was being exchanged at the right pace.” Underlying systems are just beginning to be merged, and all staff were being retained. “It wouldn’t be to anyone’s benefit if there were changes in personnel,” Culpepper said.

“It’s a really interesting time in the market,” he continued. “We are starting to see consolidation and some of that is distressed. Conversely for us, it’s been a great year. We were able to bring in AirProbe which was clearly not a distressed asset, but we saw an opportunity for growth.” He also noted the advantage they have as a “pure-play” vendor focused on scanning power assets globally. That, he feels, aids DroneBase in its ability to provide continued investment, since it doesn’t have to support other operations.

With the acquisition of AirProbe, DroneBase now has more than 59 gigawatts of both wind and solar energy assets under inspection globally through a combination of manned and unmanned systems, and is in 50 countries around the globe. Solar energy is the fastest growing and most affordable source of new electricity in America, according to the U.S. Department of Energy.