Many aspects of the construction industry are ripe for innovation. Consequently, major construction equipment firms have unveiled prototype autonomous vehicles such as Scania’s AXL, a cabless fully autonomous concept truck, and Volvo’s HX2, an autonomous battery-electric load carrier.

However, a number of startups are already bringing fully autonomous construction robots to worksites by retrofitting standard construction vehicles. This new generation of machines highlights just how much unmanned systems could transform the industry.

“What is most exciting is the genuine excitement the industry has to adopt robotics,” said Erol Ahmed, director of communications at Built Robotics in San Francisco. “From the operators to the foreman and executives, the whole construction world is primed to rethink how we build.”

FILLING IN HOLES

Autonomous machines promise a number of key benefits for the construction industry. For example, construction is currently facing a major skills shortage: a 2018 study from the Associated General Contractors of America and construction software firm Autodesk in San Rafael, California, found that 80 percent of more than 2,500 construction firms surveyed reported difficulty finding skilled labor throughout the United States. Not surprisingly, this can raise construction costs and delay projects.

“It is very hard to find skilled operators with 15 or 20 years experience, since the younger generations do not like to take on these jobs,” said Liang Wang, CEO of Robo Industries in Houston.

Moreover, construction is a dangerous business. In 2019, the United States saw 195,600 construction workplace injuries, with roughly 1,000 fatalities, according to the U.S. Bureau of Labor Statistics. All in all, one in five worker deaths was in construction, according to a 2019 report from the U.S. Occupational Safety and Health Administration (OSHA).

“If autonomous machines enter the workflow, construction workers do not need to run around machines all day—they can sit in an office far away from the operation site,” Wang said. “If workers do enter a site, they can wear a suit with RFID (radio-frequency identification) tags to make sure all machines stop when they are near them. Removing risky factors from construction operations can give a huge boost to safety.”

Furthermore, although construction is one of the global economy’s largest sectors, employing about 7 percent of the world’s working-age population and seeing $10 trillion spent on construction-related goods and services every year, the industry has a long record of poor productivity.

“While other industries have been transformed, construction has stagnated,” Ahmed said. “The effect is that, adjusting for inflation, a building today costs twice as much as it did 40 years ago.”

Globally, construction’s annual 1 percent labor-productivity growth compares poorly to a 2.8 percent rise for the total world economy and 3.6 percent in the case of manufacturing, according to a 2017 report from management consultant firm McKinsey in New York.

“Technology startups have historically ignored the construction industry because of their unfamiliarity with the market and the complexities involved in selling and distributing to construction companies,” Ahmed said. “However, this has created fertile ground for innovation.”

If construction productivity caught up with that of the global economy by overcoming common problems such as overruns in cost and time, that could boost the industry’s value by $1.6 trillion, McKinsey asserted.

“With AI [artificial intelligence] technology to optimize the whole construction workflow—where machines start and stop, how much material is pushed—you can save the amount of volume filled and reduce machine wear,” Wang said. “With full autonomy, you can operate 24-7 with no fatigue, no errors, and work in all kinds of visibility very resiliently in all weather conditions, and not depend on day or night. It could give a very powerful boost to productivity.”

UPGRADING EXISTING MACHINES

A number of companies are now helping customers retrofit existing machines to operate fully autonomously.

“We don’t manufacture or develop any vehicle or machine,” Wang of Robo Industries said. “We focus on designing retrofitting systems, include sensor packages, electronic controls, AI software and other components to transform off-the-shelf equipment into autonomous robots.”

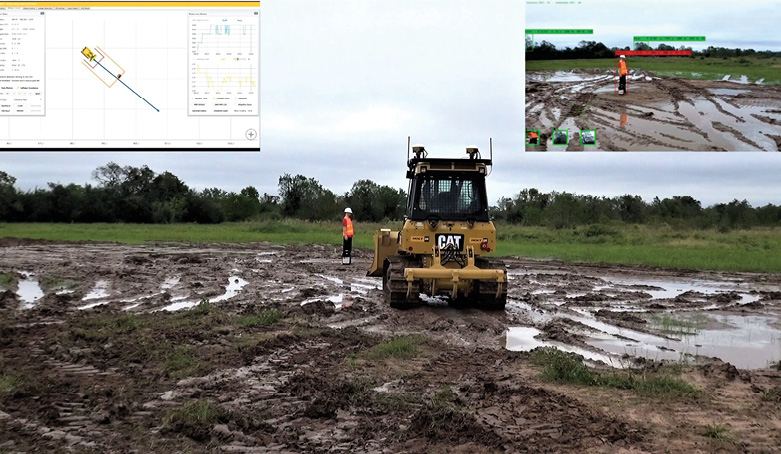

Typically, these companies first install sensors all over the equipment. Real-time kinematic (RTK) GPS systems and inertial measurement units are positioned to help the machines know where they are in space; 3D cameras, LiDAR, radar and perhaps ultrasonic sensors can help them scan their environments; and speed and pressure sensors can report specific details such as how much a wheel is spinning or whether a machine is operating with too much load. “All these sensors have redundancies—LiDAR can provide more data coverage than radar, but radar is better in foggy or dusty environments,” Wang said.

They next install electronic control systems that interface with any current machine controls. “It behaves like a virtual human operator,” Wang added. “We find the wires for the joystick, buttons, instruments and other controls and intercept and replace all the signals. Regular manual operations are still possible, but we make it so one can switch to remote control by hitting a button on a tablet, and convert to fully autonomous by tapping another button on the screen.”

Installed AI guidance systems can recognize objects in their surroundings, “running machine learning against the images and 3D data it has to understand if the object 10 meters in front of it is a tree, a vehicle or a person,” Wang said.

For Robo, when it comes to standard repetitive construction operations such as clearing a field or spreading dirt to build a foundation, traditional programming can suffice. However, “for special cases that are very hard to model, we like human operators to take over and for AI to try and learn from human input,” Wang continued. “From that machine learning, hopefully we will get better results during autonomous operations, which we can then transfer to other machines.”

Robo has partnered with original equipment manufacturers (OEMs) such as Komatsu and LiuGong so that no mechanical modifications are needed to control compatible machines. Instead, electronic control systems installed in the vehicle’s cab can pilot the machine via a wired or wireless connection. The progress of machines can get tracked anywhere globally using a cloud system, Wang added.

Robo can retrofit bulldozers, aims to retrofit excavators by 2021 and is currently working on retrofitting wheel loaders. Built can retrofit excavators, bulldozers and skid steers, and its AI guidance systems have also been installed on a few other types of specialty equipment for testing.

WORKING WITH CONSTRUCTION ROBOTS

For Built customers, a typical day would involve a robotic equipment operator arriving on the jobsite in the early morning. “He or she will perform a number of protocols to get the robot running, such as selecting the task it will work on, defining parameters, fueling and safety checks,” Ahmed said. “Then the machine will begin operating—for example, trenching, excavation or earthmoving. At this point, the robotic equipment operator’s work is finished, and he or she can work on other tasks, start up another robot or continue working elsewhere on the job site. While the robot is working, it will send any notices or alerts to the robotic equipment operator if it needs guidance. Otherwise, the robot works until finished. Once finished, the robotic equipment operator will return to the robot and check its work and perform the shutdown procedures.”

Similarly, with Robo “one operator can monitor three or four autonomous machines at the same time, only interrupting their work flow when necessary,” Wang said. “If you run into issues, you can switch to remote control and put that issue into the log so the AI can learn from it. Most of the time, they will run by themselves.”

According to Robo, its systems can achieve about 1 inch of accuracy when it comes to positioning a dozer blade or an excavator bucket and 1 or 2 inches of accuracy when driving vehicles around. Similarly, Built’s machines have a movement resolution of less than 2 centimeters, “which is usually required for most civil projects, and is the precision used most often by our customers for their work,” Ahmed said.

Upgrades can increase customer productivity by 63 percent, according to the company. Moreover, by delivering fully autonomous machines with 24-7 operating capabilities, optimized task planning, job progress tracking and efficient fuel consumption, among other advantages, Robo suggests its upgrades could save construction firms $65,450 per machine each year.

Training customers on how to use these systems is a quick affair. “We go over how to install the sensors, how to maintain the sensors, how to clean them and to check all the electronics,” Wang said. “Then, with the software, we go over how to set the operational parameters—if they want to clear or fill an area—and then how to set up boundaries. Typically, training is as quick as one or two days, sometimes three, four, five days. It’s possible to do training with a phone conversation over one or two hours.”

Built is developing a curriculum for robotic equipment operators, in which students will learn and implement safety protocols, set up job sites and safety perimeters, define tasks and run them autonomously, work with GPS and construction plans, install and troubleshoot guidance systems, analyze business and efficiency metrics, and complete their training with hands-on experience running robots in actual jobsite conditions. The aim—“when the robots come, you’ll be their boss.”

“Robots require new skills and ways of working at the jobsite, which is enabling a new class of laborer to exist,” Ahmed said. “Upskilling workers into new careers will protect jobs from changes in the market. By letting robots handle mundane tasks, existing skilled laborers can focus on new types of work and higher-level demands.”

What sets Built apart, Ahmed said, is how it is “the only company offering commercial-grade autonomous construction equipment today. In some other industries like mining, robotics has made headway, but Built Robotics’ guidance systems are the only solutions currently available for construction.”

What sets Robo apart? For Wang, it’s how the company partners directly with OEMs to help prove Robo’s technology and integrate Robo’s systems into their machines. “We do not want customers to worry about the burden of handling two sets of systems—they just want one nice clean system,” Wang said. “I hope that in the future, we can work with OEMs so customers can get systems installed at dealerships and get training there as well, the same business flow as with their other machines.”

CONSTRUCTION PROS AND CONS

One advantage of developing autonomous vehicles for construction is that jobsites “are relatively constrained environments with controlled variables compared to public roads,” Ahmed said. “Jobsites have fewer people, and those who are present are trained professionals. So, the robots can work in a more predictable setting than the challenging environments faced by self-driving cars.”

In addition, “construction is full of discrete tasks that can individually be automated without disrupting other parts of the process,” Ahmed added. “This allows the robots to focus on one problem, solve it well and move on to the next task.”

All in all, “it is faster to develop and deploy robots in construction,” Ahmed said. “Construction sites function differently from public roads, where there is a larger body of regulatory laws. Different government agencies have oversight of requirements for running equipment on public roads that construction sites do not need to take into account. The technology can be deployed faster because the robots can be deployed in specific terrains and environments.”

On the other hand, whereas self-driving cars generally only have to go from one point to another on a relatively flat landscape, “construction machines often operate in full 3D,” Wang said. “And they are not just moving around—they are changing the shape of their terrain, and they have to understand how their changes might affect their jobs, and they may have to deal with underground conditions that are very different from surface conditions.”

Construction robots “deal with very tough operating environments—dust, fog, rain, extreme cold—all these things can be challenging for sensor accuracy and the ruggedness of the systems,” he continued. “And the working environments are very diverse—sometimes a bulldozer might go through a very grassy area with bushes and trees, other areas may have a lot of rocks, and others might have heavy, muddy clays or loose sands. It’s hard to make a system fully optimized for all these conditions.”

A challenge specific to retrofitting construction vehicles is the sheer variety of manufacturers and models. “Some are five years old, some are 10 years old, and they may have different interfaces,” Wang said. “It is easier if you have full support from an OEM.”

The key factor to remember when it comes to construction is that “this industry emphasizes safety and productivity,” Wang said. “They don’t allow too much room for experimentation. They just want to write a check and get something really beneficial and reliable.”

In the future, autonomous construction vehicles may collaborate with unmanned aerial vehicles and other robots to operate even more efficiently on construction sites. “Some companies are working on open protocols to allow different internet of things [IOT] or robotic platforms to communicate through standards,” Ahmed said. “I think that will be essential to having different machines work together. On top of that, having different machines work together safely—both for themselves and the people around them—will be critical to collaboration.”

Robo also can see itself becoming a hardware-as-a-service company. “Instead of spending time on retrofitting and learning how to use our machines, we could just provide a fleet of equipment to a job site, and we can control them to get the job done as quick as possible, and we just get paid operating expenses and rental fees,” Wang said.