Scaling drones and robotics as utilities transition toward zero emissions.

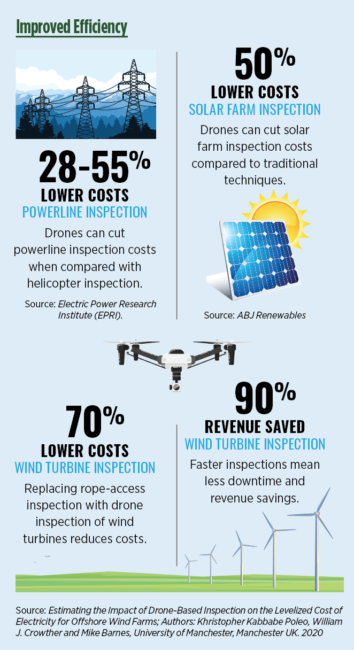

Drones have proven their value among energy firms despite regulations. UAS reduce the need for costly and dangerous inspections, improve the quality of data collected and save time. Reducing the downtime required during inspection adds further savings. The next step for many utilities is to scale use throughout their organizations.

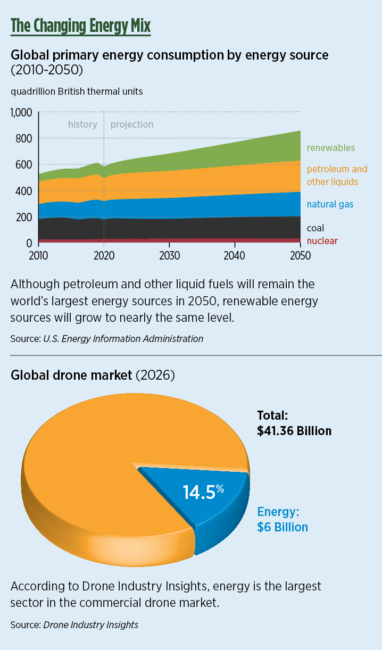

Kay Wackwitz, CEO & founder of Drone Industry Insights, said energy currently represents the largest sector of the commercial drone market. By 2026, commercial drones in energy will be valued at $6 billion, or 14.5% of a $41.36 billion market.

Furthermore, a 2021 Drone Analyst Market Report found that, among utilities, nearly half of firms spent more than $50,000 on drones, and many spent well above that amount.

“There is certainly a high interest to leverage cost and times savings by utilizing a higher degree of automation and increasing the operational radius,” Wackwitz said.

“Virtually all utility providers currently use manually operated drones and/or basic GPS-based automated flights to collect data via drone service providers or in-house programs, but manual data capture is not the ideal solution for scalability,” added Kabe Termes, director of solutions engineering for Skydio, of Redwood City, California. “Training requirements for operators are high, flight efficiency can be low [especially with pilots who do not regularly fly] and data review is tedious.”

Termes believes more widespread adoption of drones will be driven by improved flight autonomy, AI analytics and regulatory pathways that allow for remote operations. “Any time you can relieve the operator of spending any mental collateral on functions such as preventing collisions, they can spend more time focusing on the mission at hand,” Termes said.

Automated drones and AI analytics make the collection of detailed data more efficient, consistent and rapid. And while the operator/pilot is still present, data can be collected to build a safety case for automated drone inspections without the direct oversight of a human operator/pilot.

THE IMPACT OF NET-ZERO

According to the International Energy Outlook 2021 from the U.S. Energy Information Association, global energy consumption will rise nearly 50% over the next 30 years. The energy industry is undergoing a massive transition as efforts to reduce emissions take place around the globe. Even with the huge investments required to pull it off, more than 136 countries have pledged to reach net-zero emissions, including China, the U.S., Germany and the EU. Together, these four countries account for nearly 40% of all emissions.

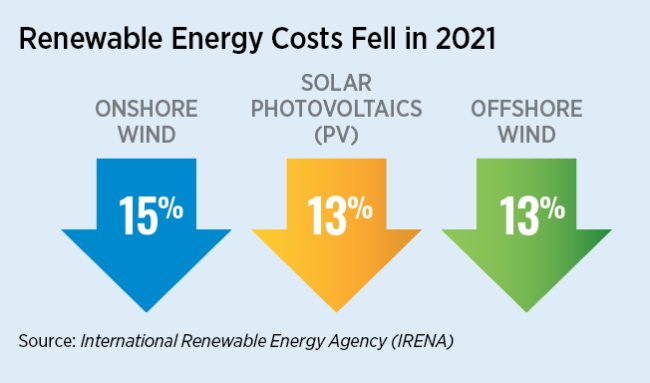

Rising fossil fuel prices and lower costs for renewable technology are spurring investment in renewables. Europe’s energy security crisis is raising additional concerns. In a survey conducted by the World Energy Council in April, more than 50% of global respondents expect faster energy transitions as a result of the energy crisis. And, as analyzed in this issue’s feature on methane (p. 48), the energy sector is responsible for about 40% of total methane emissions attributable to human activity, second only to agriculture.

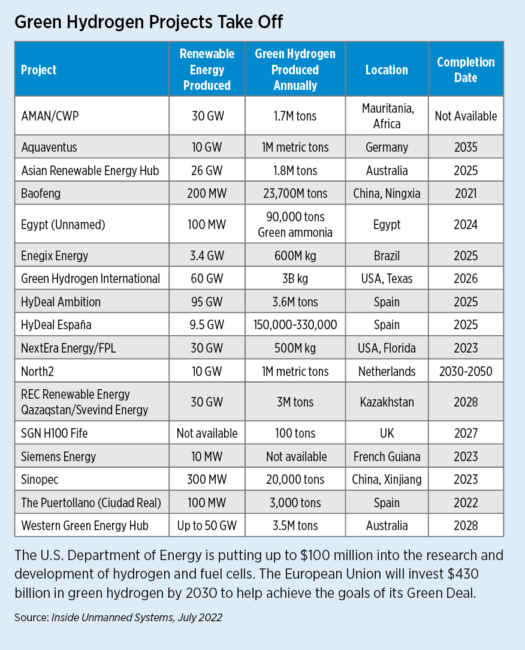

The declining cost of renewable energy is one reason for the growing interest in green hydrogen—a hydrogen fuel created using renewable energy instead of fossil fuels. Green hydrogen is produced through the electrolysis of water, leaving nothing but oxygen as a byproduct. Most experts believe green hydrogen will play a key role in meeting net-zero. It’s significant because it has the potential to decarbonize energy-intensive processes such as making steel and cement, as well as in shipping and transportation where it can be used as fuel. Green hydrogen also can be used with fuel cells to power anything that uses electricity, such as electric vehicles and devices. Unlike batteries, hydrogen fuel cells don’t need to be recharged, as they have hydrogen fuel (For more on green hydrogen use, see SoCal Gas Use Case.].

U.S.-based NextEra Energy, one of the largest utilities in the world, recently announced Real Zero, a commitment to eliminate carbon emissions from its operations by no later than 2045, leveraging low-cost renewables to drive energy affordability for customers. A significant portion of this plan will take place at Florida Power & Light Company (FPL), NextEra’s principal subsidiary, which is the nation’s largest electric utility, serving more than 12 million people.

According to FPL, the company has already improved its carbon-emissions rate by 40% over the past 20 years. To reach “Real Zero,” the company will rely on a diverse mix of solar, battery storage, existing nuclear, green hydrogen and other renewable sources. Solar capacity will be increased to more than 90,000 megawatts. Additional battery storage (50,000 megawatts) will be added to the grid, up from 500 megawatts today. Existing natural gas units (16,000 megawatts) will be converted to run on green hydrogen. FPL also plans to generate up to 6,000 megawatts of carbon-neutral power with renewable natural gas (RNG).

WHAT A CHANGING ENERGY MIX MEANS FOR DRONES AND ROBOTICS

“Autonomous drones are going to play a big part in reliability and the way to maintain the grid safer and more economically,” said Eric Schwartz, manager of technology & innovation at Juno Beach-headquartered FPL.

“A smart grid and smart devices will only get us so far [in identifying problem areas], “Schwartz said. “It will get us to a quarter mile or less than a quarter mile from where the issue is. The drone will be the next step in the process to narrow it down and find the active spot.”

Schwartz views regulation as one of the potential limiting factors facing the drone industry, but there continues to be progress.

In July, Dominion Energy and Skydio announced a pivotal waiver that allows Dominion to inspect 40-plus energy generation facilities across seven states. The waiver allows individual operators to fly drones BVLOS. “Skydio’s vision-based autonomy makes it one of the only solutions available for automated flight within energized environments,” Termes said. “Because we do not utilize magnetometers for vision-based navigation when flown manually or autonomously, pilots can safely fly their missions in close proximity to structures.”

On its solar installations, FPL uses drones equipped with thermal imaging to identify dead spots and defects, at installation and during annual inspections. Vip Jain, CEO of ABJ Renewables, a drone inspection company specializing in renewables, said about 2 to 3% of the panels develop bad cells each year. That can reduce efficiency.

FPL completed approximately 6,000 wind turbine inspections last year (out of 11,000 total wind turbines). “We are doing it to check for cracks and damage to the blades,” Schwartz said. If a small crack is found before it becomes a larger issue, it greatly reduces maintenance costs.

By focusing on proactive maintenance, Jain said ABJ Renewables has been able to increase the electricity coming out of wind farm assets by 30%. The global company’s WindVue technology can detect such substructural internal wind turbine generator blade defects as bonding, delamination, cracks, wrinkles and lighting damage, as small as 3 to 4 millimeters with minimal downtime. It uses both thermal and optical imaging. “Most of the damages start inside the blade,” he noted.

Offshore wind is growing with the development of floating wind turbines that can be installed in deeper waters, where winds are higher. Instead of being rooted to the seabed, the floating structures are secured to the seabed with mooring lines and anchors. Though these drone inspections are complicated by floating turbines, high winds and inclement weather, they can reduce maintenance costs and foster safety.

Unlike Schwartz, Jain doesn’t believe automation technology is ready to take the place of drone pilots. “The reality is, are you willing to risk a mistake and crash into a multimillion-dollar asset?” A recent study found that increasing the autonomy of drone operations increases the speed at which inspections can be performed but introduces additional costs in terms of complexity and compliance with regulations. As such, the study authors found only a 2% reduction in inspection costs with fully autonomous operations and a drone fleet commanded by single remote supervision.*

“The biggest struggle is that renewable power is new and power companies don’t understand what is required to run them efficiently,” Jain said. “Without proper maintenance they will not get enough productivity out of the assets.”

Drones aren’t the only tool for utilities. Robots are getting attention as well. A 2021 study from Drone Analyst found 63% of energy and utilities companies planned to purchase or already purchased robotics systems.

FPL currently operates eight autonomous rovers: two at fixed locations and six mobile units, along with two Spot robots. They use the rover for automated daily inspections around the substation, looking for thermal intrusion, digging at the fence line (signs of animal intrusion), and hotspots. “Use of rovers is not as widespread as drones, because they are limited in their use due to limited battery life,” Schwartz said. Spot robots are still in the pilot stage, but FPL is using them at its nuclear and gas power generation facilities.

Tremendous change is coming in the energy sector and drones and robotics will play a significant role in ensuring efficiency, reliability, safety and security. Moving from pilot programs to everyday work tools will only discover more use cases that will increase their value to the sector.

*Source: Estimating the Impact of Drone-Based Inspection on the Levelized Cost of Electricity for Offshore Wind Farms.Authors: Khristopher Kabbabe Poleo, William J. Crowther and Mike Barnes, University of Manchester, U.K., 2020.