Jonathan Downey (center) and the Airware founding team. Photo courtesy of Airware

Despite delays caused by dense regulatory fog, investors are jockeying for position and betting tens of millions of dollars as they wait for the race to commercialize unmanned aircraft to begin.

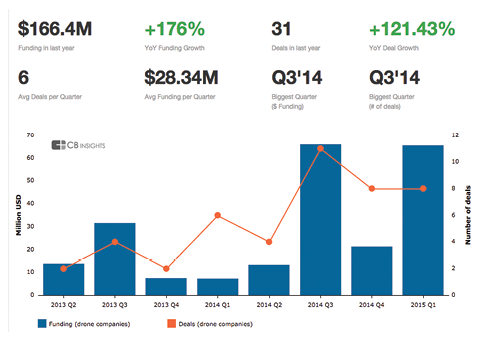

Venture capitalists poured $166 million into unmanned aircraft companies from April 2014 through April 2015—a 176 percent increase over the same period the year before, according to data from CB Insights. There was more

money invested in unmanned aircraft systems (UAS) during the first quarter of 2015 than in any quarter in the previous five years.

And the industry may be poised to give birth to its first multi-billion dollar company.

Though not a classic unicorn, which is generally defined as a U.S. startup firm software firm valued at $1 billion or more, 9-year-old China-based DJI is reportedly in negotiations with venture capitalists for an infusion of cash that would put its valuation at more than $10 billion.

Bilal Zuberi of Lux Capital Photo courtesy of Bilal Zuberi

Hot, Hot, Hot

Despite the fact that the rules for flying unmanned aircraft, more commonly called drones, remain largely unsettled, industry front-runners have already emerged.

UAS maker 3D Robotics, which recently announced a smart drone incorporating camera automation, has raised $85 million in three rounds of financing including a $50 million Series C round announced in February. Airware has raised more than $40 million—though exactly how much more is unclear, because the specifics on the company’s deal with GE Ventures remain under wraps. DroneDeploy has raised $11 million and CyPhy Works $10 million plus an additional, no-details-revealed $2.5 million in debt financing in March.

“We’re in a very hot field right now,” quipped CyPhy Works CEO Helen Greiner.

Greiner would know. One of the most experienced robotics entrepreneurs in the industry, she co-founded iRobot in 1990, raising $35 million in venture capital for the firm, which is probably best known for the Roomba autonomous vacuum. She led iRobot through a successful $75 million initial public offering, leaving in 2008 to found CyPhy Works.

Helen Grenier of CyPhy Works Photo courtesy of CyPhy Works

On the surface investor enthusiasm would appear to be tracking efforts in the United States to clear regulatory barriers. Congress passed the FAA Modernization and Reform Act of 2012 in February 2012. The law ordered the Federal Aviation Administration to create a regulatory plan and specific rules to integrate unmanned aircraft into the national airspace system. It also directed the creation of federal test ranges for drones and gave the FAA the authority to issue exemptions from current aviation regulations under Section 333. That last measure is currently the primary avenue for companies to begin commercial operations in the United States.

The bill was signed into law on Feb. 14 and within months the founders of Airware had raised $220,000 in seed capital from family and friends, setting up the company for later fundraising success. 3D Robotics inked a $5 million venture capital deal in November.

By the end of 2013 the FAA had announced its regulatory plans and set up six UAS test sites. Investors kept pace, completing 10 deals totaling more than $53 million. In 2014 the FAA began issuing case-by-case exemptions, allowing limited commercial flights. Investors more than doubled their commitment—pushing through another 29 deals worth $108 million. That growth curve appears likely to continue this year. Eight deals worth nearly $66 million were cut during the first quarter of 2015, according to CB Insights.

But while news coverage of the regulatory progress likely helped fuel interest, experts say it is breakthroughs in technology and new business models that are really attracting investors.

The Investors

Venture capitalist Bilal Zuberi, a partner at Lux Capital, said reduced development costs, which enable entrepreneurs to more easily try out their ideas and demonstrate new hardware, are a key factor in the groundswell of commercial investment.

“It used to cost a ton of money before you could even see something move,” Zuberi told Inside Unmanned Systems. “And now two college students in their dorm room can order parts online and code the firmware, or download an open operating system, and have a drone fly.”

Lux Capital may soon be backing some of those inventive dorm-dwellers. On April 2 the firm launched a new $350 million fund that will target robotics including drones and other products spun from laboratory breakthroughs and engineering prowess.

“Lux Capital explicitly invests in sort of moonshot ideas that rely on advances made in the fields of science and engineering. So typically things that are more technically dense and deep,” Zuberi explained. ‘Things that tend to include hardware, software, data analytics—a pretty broad brush of different areas of technology.”

The firm’s interest in data analytics underscores what Zuberi believes is a key element in the rush to invest in UAS. He said data analytics is enabling new and very attractive business models that derive revenue from the data that drones gather, and not just the sales of hardware and services.

“People are not just interested because somebody will buy 100 drones,” Zuberi said. “That’d be fine, but I think what’s really important is that those hundred drones will be collecting a ton of data… all that data cannot only be used to create very high value products but it can also potentially be shared with multiple customers. The same data can essentially be resold in different ways to different people.”

If someone, for example, used an unmanned platform to image California, he said, you could create a high-resolution map that would be useful to solar-panel companies compiling lists of potential customers based on the size and slope of their roofs. Governments might be interested in a slice of that data set for taxation purposes and insurance companies for their own business decision making.

“So now you can start creating a business model that not only is much more profitable, with very high margins, but also something that venture capitalists have been very successful in monetizing in the past,” Zuberi said.

Robust funding and deal growth. Chart courtesy of CB Insights

Taking the Long View

To foster such success Lux Capital is willing, for the right projects, to stretch out the famously short time frames of typical venture capital investments.

“Moonshot ideas don’t take two years to build,” he explained. “…Usually, on our dime, we see companies spend 1 to 2 years just turning their technology into a product. Companies take 6 to 8 years to reach the level of maturity where we feel we have now optimized on our return profile.”

Lux is not the only firm with the patience to ripen groundbreaking technology. Paris-based Robolution Capital, which invests exclusively in robotics, will stick with a firm for as long as eight years if that’s what is takes, said Renaud Champion, a partner in the firm.

Robolution is focused on disruptive technologies—unmanned systems that are more intelligent or capable of swarming or of using new techniques like wolf pack algorithms as the basis for optimal, collective action. Champion said his firm is also interested in underlying technologies including new approaches to power systems or managing energy and different ways of controlling a drone, like follow-me capabilities, that go beyond using smart phones or tablets. He is monitoring systems that can shift from using fixed-wings to rotors or go from traveling in the air to along the ground. He added that he’d be interested in finding a UAS that could go from flying in the air to diving into a body of water.

Robolution is also weighing investments in some of the many aerial platforms being developed, Champion said, but is looking at those bets in a very strategic way.

“There are many, many, many players,” in that arena, Champion told Inside Unmanned Systems, and he believes they will soon begin consolidating through well known, high-level firms like DJI and Paris-based Parrot. With that in mind, his firm is investing in startups that can either grow quickly or are likely to become candidates for acquisition.

Champion has deep roots in the European robotics community that help him find investment opportunities and stay abreast of the latest developments. He is on the board of directors of the European robotics association, euRobotics AISBL, and is general secretary and treasurer of the French Federation of Professional and Personal Service Robotics (Syrobo).

Champion makes a point of meeting with the end-users that frame product demand, he said, as well as the universities, labs and incubators where new technology is born. Though relatively new (Robolution has only been active since January 2014) his company is so involved in the robotic ecosystem, he said, “it’s natural for us to discover new companies.”

Nonetheless, he and Zuberi both say they regularly speak at conferences and hand out cards to help them make the connection with promising entrepreneurs. Zuberi also blogs at bilalzuberi.com and is active on social media.

“I openly give out my email,” Zuberi said. “Talk to me. I’m in the business of going out and finding a needle in a haystack. I understand that and I am fine with that.”

Hatchlings

Even though venture capitalists and entrepreneurs are searching intensely for each other, making a connection with real business chemistry is tough. To help with the matchmaking, universities, governments and even individuals with startup expertise are launching incubators around the globe.

The three co-founders of DroneDeploy got their big break when they were accepted into AngelPad, a seed-stage incubator in San Francisco started by Thomas Korte and six other former Google employees.

Rated as the top accelerator in the U.S. by the Seed Accelerator Rankings Project [see Resources for Entrepreneurs p. 22], AngelPad supports firms in their formative stages with a small amount of cash and a lot of expertise. The staff works with entrepreneurs over a period of three months to help them hone their business plans, polish their presentations and connect with angel investors and venture capitalists.

It’s “like school for startups,” said Mike Winn, DroneDeploy’s CEO.

But finding investors is about much more than finding money. The trick, entrepreneurs told Inside Unmanned Systems, is to find people who ‘get’ your product and have the insight, expertise and experience to help you build your firm. Those investors will often serve on the company’s board, tapping their personal networks to help firms grow.

“That is probably the most important part of taking investments,” Winn said . “You’re not just taking money—you can get money from anyone including the bank. What you’re really looking for are investors that can help take you to the next level.”

DroneDeploy emerged from its 3-month boot camp and went on to raise an additional $11 million—$2 million of it from AngelPad. It now provides software that works on a range of different drones and fast cloud-based data processing on a subscription basis for as little as $99 a month.

Consumers without flight experience can launch an unmanned aircraft equipped with DroneDeploy, have it run through a preset pattern for data gathering and get real-time imagery. The data can be used to create 3D maps and assess the health of fields or monitor the productivity of a mine. The software, which now can be accessed with a mobile app, is available for a number of the most popular UAS including DJI’s Phantom 2 Vision+, 3D Robotics IRIS+ and AgEagle’s Rapid fixed-wing platform.

San Francisco-based Airware followed a similar fund-raising path.

Founded by Jonathan Downey, in April the company released its Aerial Information Platform (AIP) an “operating system” for unmanned aircraft that includes an autopilot, a hardware module and cloud-based data processing software. Useable on a wide variety of UAS, the AIP package makes it possible to use the same familiar interface to operate different rotor and fixed-wing UAS then convert the raw data into useful tools like maps.

The idea for the firm goes back to when Downey was an undergrad at the Massachusetts Institute of Technology, trying to build small drones for an intercollegiate competition. The software and the electronics that were available were either made for hobbyists and not sufficiently reliable, or based on defense technology and too hard to customize.

“So we built all our electronics and software kind of from scratch,” Downey said , “which took a long time and cost a lot of money. And we thought, surely there must be a better way.”

Building on their initial support from family and friends, Airware won a spot at Lemnos Labs, another hardware incubator in San Francisco and then a stint at the accelerator Y Combinator, which ultimately invested $3 million. Just three months later the venture capital firm Andreessen Horowitz called— a call that led to a Series A round of financing totaling $12.2 million.

“When we raised our Series A financing from Andreessen Horowitz, we weren’t at a point where we really needed to raise that money. We could have waited another 6 to 9 months given the $3 million we had just raised,” Downey said . “But raising money can very much be a distraction to entrepreneurs and CEOs from really running your business. And when Andreessen—which I believe is one of the most helpful venture capital firms—called saying they were interested in investing in Airware and interested in investing a serious amount of money, we kind of jumped at that opportunity. And they’ve been incredibly helpful to the company over the last two years now.”

GE Ventures, the firm’s first enterprise investor, put an undisclosed amount of funding into Airware in November 2014. They were drawn, Downey suggested, by the ability of AIP to work across a wide variety of platforms.

“When they looked at their different needs for drones, like a lot of companies they realized it isn’t going to be just one single type of drone, or one drone for a single purpose, that they needed. They will likely need multiple drones—fixed-wing aircraft for doing longitudinal surveys like power lines and pipelines; but they also need smaller multi-rotor drones for doing vertical inspections of things like windmills or other vertical structures,” Downey said. “… I think GE saw that flying these drones from multiple different companies could lead to an enormous pain point for them.”

Integration work at Airware. Photo courtesy of Airware

Problem Solving

The critical importance of developing products that solve problems—address real-world pain points—was mentioned by every one of the entrepreneurs and investors who spoke to Inside Unmanned Systems.

Champion said he can invest in technologies that have yet to be developed into products, and then assist the firm in finding its market, but he prefers to find advances for which there is already a clearly identified need.

“I would rather invest in a company that is solving someone’s problem,” he said, “than invest in a company that has a cool technology but we don’t know the use for it.”

Zuberi agreed, saying that Lux Capital would go so far as to launch a firm itself if it found an opportunity no one was addressing that it felt strongly about.

“If you’re going to do something hard in life you might as well be doing something that’s worth it,” Zuberi said. ‘If you’re building a little widget or gadget, I’m not interested. But if you’re solving a real problem, I’m interested.”

Greiner had that problem-solving approach when she launched CyPhy Works, which she initially funded herself.

She said she found people were gravitating to rotorcraft UAS because they were easier to control and more convenient to operate than fixed-wing platforms. Users were frustrated with the systems, however, because they wanted them to be able to stay aloft longer.

“So we were looking around at ways to do that,” Greiner told Inside Unmanned Systems, “and usually the simplest solution is the best.”

The result was the PARC rotorcopter (for Persistent Aerial Reconnaissance and Communications) that can, well, park over a specific spot indefinitely.

Using a microfilament tether for power, the aircraft is able to hover for long periods at altitudes of up to 500 feet. Radio communications to the drone can’t be jammed and data is secure because it all goes through the tether.

“They just sit there and they’re working 24/7,” Greiner said.

Airware’s Aerial Information Platform works on many types of platforms. Photo courtesy of Airware

Collision Avoidance

Love Park Robotics founder Tom Panzarella is tackling a different problem—collision avoidance.

Panzarella has developed CoPilot, a 3D visualization software that is able to ‘see’ the elements in a space and maneuver around them. Incorporated into a wheelchair, the code makes it possible for someone to get around and steer easily through a door, even if they are only able to manipulate the wheelchair by pressing head pad controls. His firm is now working to apply the software to equipment that moves material around inside warehouses.

“We’re working on a technology that enables them to recognize pallets—the position and orientation of the pallet with respect to the fork truck,” Panzarella said.” It takes them right now five seconds to localize it, once they approach it. We can do it in one 20th of a second.”

He believes the same technology can be embedded into the fight loop of an unmanned aircraft to help address the biggest pain point the industry has right now—the need for sense and avoid.

The technique is quite different from other approaches that rely on air traffic control-like techniques, he said. Moreover, putting the software on the aircraft makes it possible for the UAS to react in real time and avoid collisions even if something happens to the centralized system.

Panzarella is an experienced entrepreneur who has already helped launch, build and sell a startup. Though it’s too soon for Love Park to seek venture capital, he said, the firm already has commitments for $100,000 of the $300,000 it needs to do further development.

The Next Level

While Love Park may not be ready for venture capital, the surge of VC interest in unmanned aircraft may be just the resource the UAS industry needs to address its own pain point—regulation.

The venture capital community, with its network of backers and get-it-done approach, has a stake in the UAS industry that did not exist when the last FAA reauthorization bill was written.

Lawmakers are now crafting a new FAA reauthorization and must determine just how much money they will actually allocate to support their decisions. Though they are weighing significant changes for the FAA’s structure, it is not clear how those changes will impact the UAS community or if more resources will be made available to the FAA’s Unmanned Aircraft Systems Integration Office, which by all accounts is overstretched.

With this powerful new constituency paying attention, however, Congress may step up to invest the requisite resources and provide the necessary follow through to speed integration and take the industry to the next level.