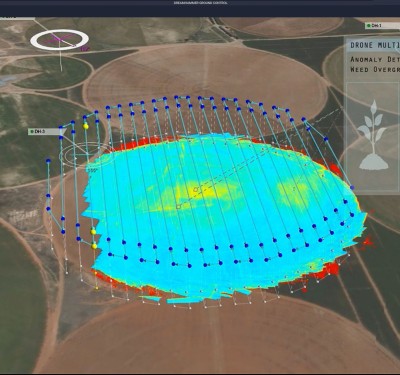

Image courtesy of Airware

Two of the unmanned sector’s leading commercial players have launched venture capital funds aimed at advancing the drone industry and, perhaps, solidifying their positions at the center of smart phone-like networks of application developers.

DJI, the world’s largest builder of drones, has launched a $10 million investment fund with Accel Partners, of Palo Alto, Calif. The investment vehicle, called SkyFund, will support hardware and software entrepreneurs who are building applications based on the DJI infrastructure.

“We want to make it easier for people to be innovative with the technology that we design,” said DJI Product Manager Paul Pan in a video about the fund.

Developers will have access to the documentation and the software development kit or SDK, said Accel Partner Vas Natarajan, and “they’ll have access to the folks behind the SDK.”

“We’re providing the technical knowhow and the resources to help any entrepreneur really take advantage of what the SDK can provide,” Natarajan said in the video. “We think there’s a huge opportunity to unlock the application layer innovation in drones and UAVs (unmanned aerial vehicles).”

The firm will also help with resources such as marketing expertise and technical support, DJI spokesperson Michael Perry told Forbes, and would give SkyFund companies preference for product testing.

Accel clearly believes in Shenzhen-based DJI. In addition to being a partner in the new fund, they invested $75 million in the firm earlier in May. The venture capital firm sees a big future for the hardware manufacturer, which Accel Partner Sameer Gandhi, described as offering an opportunity to build a platform company like Facebook, Google or Amazon.

On the same day SkyFund was introduced, San Francisco-based Airware announced its Commercial Drone Fund, which will make investments of $250,000 to $1 million in early-stage drone firms.

The fund will focus on firms working in sensor hardware, software applications, cloud-based aerial data analysis tools, drone-based services, and complete solutions for specific industries.

The fund has already invested in Redbird, a cloud data analysis company in Paris, and London-based Sky-Futures, a leader in oil and gas data capture and analysis by commercial drone.

“Redbird is known in Europe for having the most advanced drone data analytics for mining, construction, and infrastructure inspection. Our cloud-based platform for enterprises is designed to fit within existing Airware workflows. We are very excited by this investment as it validates the added-value we’re bringing in the drone ecosystem,” said Emmanuel de Maistre, co-Founder and CEO of Redbird in a statement.

The Commercial Drone Fund expects to invest in dozens of startups over the next two years, the company said. Though many of the chosen companies will be using Airware’s Aerial Information Platform, that is not a requirement for funding, the venture capital group said.

The fund is separate from Airware and does not count Airware as an investor. Its backing comes from a group oflimited partners led by Airware’s CEO, Jonathan Downey, who is the fund’s general partner.

“While the commercial drone industry is evolving rapidly, we still see gaps in the ecosystem. The Commercial Drone Fund will identify and boost the rising stars that are advancing important drone-related initiatives, such as powerful new sensors, intelligent analytics, or innovative field services,” said Downey. “I know how hard it is to raise early money in a new space and I want to help other entrepreneurs get further faster.”